Economic & Market Review: Q1 2024 [Webinar Summary]

Presenters: Lowell Pratt, CFA, Andy Pratt, CFA, CAIA, and Adam Newman, CFA, CFP®, MT, RICP®

Here is the webinar recording from April 24, 2024. You can browse topics discussed and main takeaways using the sections and time stamps below:

Click the time-stamp in each section title, and you will jump right to that part of the video in a new screen!

- Introduction & Burney Credentials (00:00)

- Quarterly Market Summary (03:07)

- Long-Term Market Summary (07:59)

- Strong Quarter for Growth, Especially Mid-Growth (16:33)

- April Drawdown Looks Fairly Uniform (19:08)

- How the Inflation Picture is Different than 2022 (20:55)

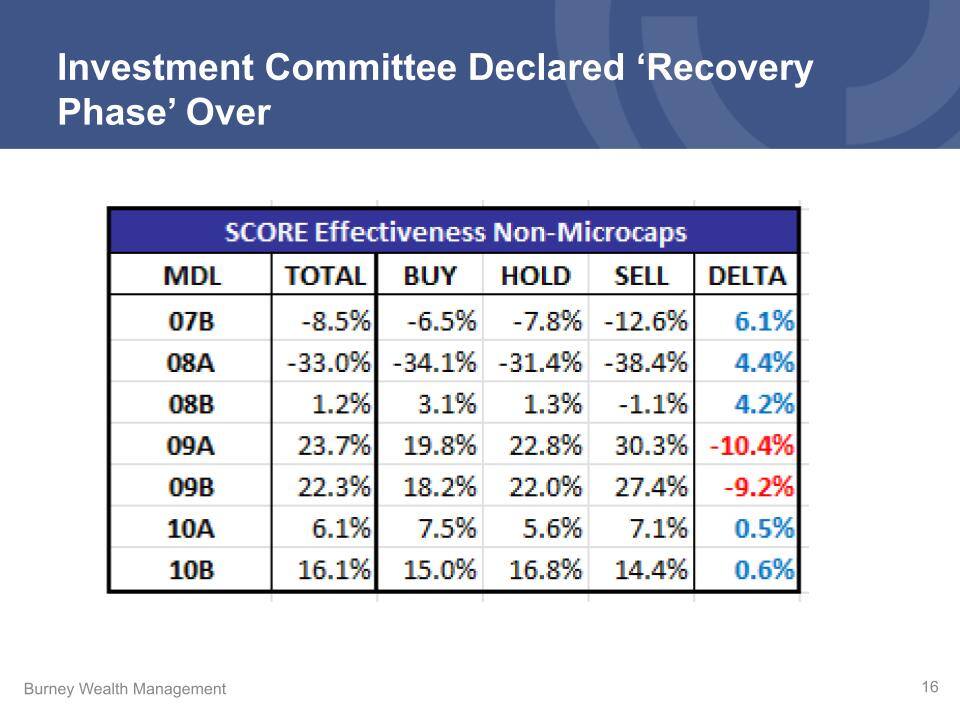

- Investment Committee Declared 'Recovery Phase' Over (26:41)

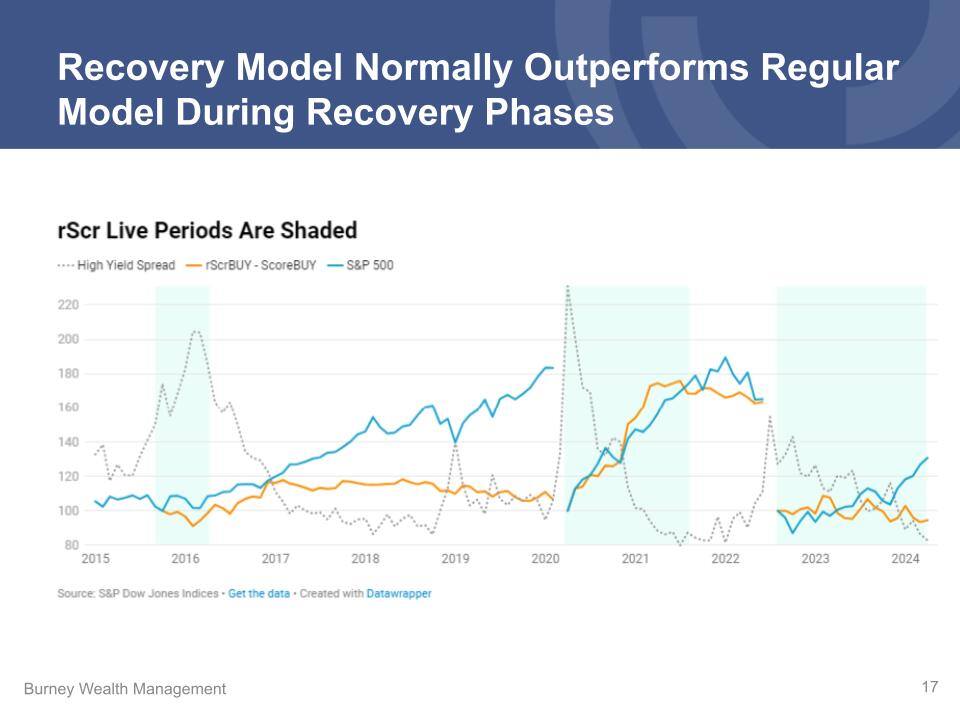

- Recovery Model Normally Outperforms Regular Model During Recovery Phase (29:39)

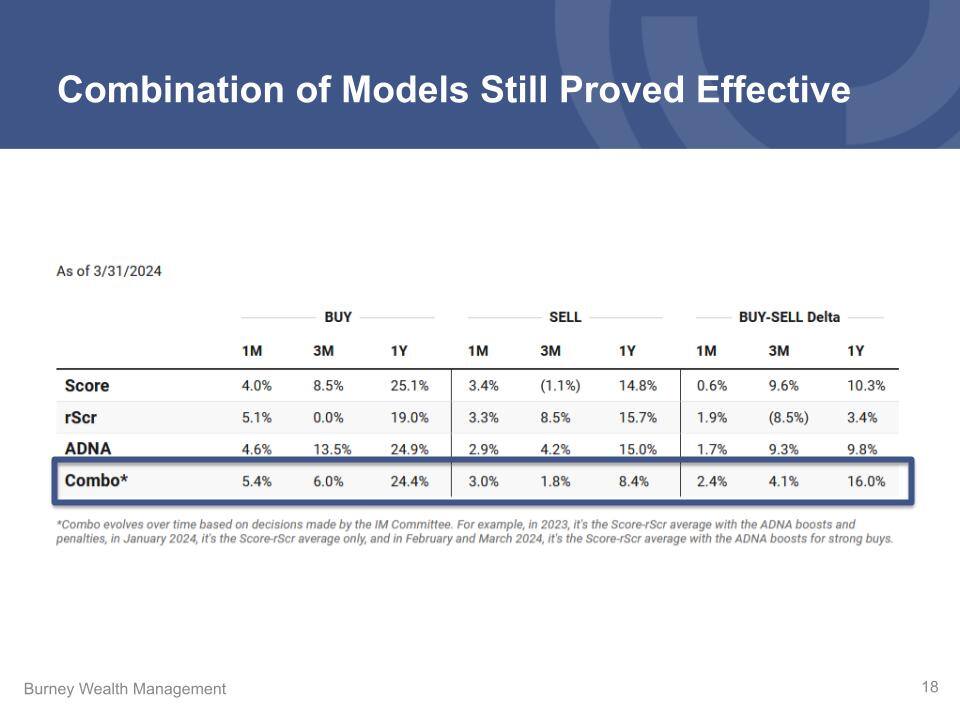

- Combination of Models Still Proved Effective (30:51)

- Live Q&A (32:15)

Introduction & Burney Credentials (00:00)

%20Q1%20Economic%20and%20Market%20Update.pptx.jpg?width=960&height=720&name=(03.31.24)%20Q1%20Economic%20and%20Market%20Update.pptx.jpg)

-

Overview of Financial Performance: Lowell previews how Adam will discuss global asset tax returns, recent market corrections, and the implications of stocks reaching all-time highs, highlighting the firm's performance and strategic adjustments in light of these developments.

-

Updates on Stock Responses to Inflation and Strategy Adjustments: Lowell previews how Andy will address how stocks are reacting to new inflation data and discuss the firm's decisions regarding the operational status of a recovery stock selection model, reflecting on strategic positioning.

-

Global Political Impacts on Markets: Lowell calls out that the presentation acknowledges the geopolitical tensions in Ukraine and Israel, noting how these are factored into current security pricing and the potential for market volatility due to fears of conflict escalation, especially regarding impacts on oil supplies.

-

Firm Philosophy and Credentials: The firm's motto "Performance Matters" is introduced, rooted in a philosophy of comprehensive performance in equity management, financial, and tax planning. The discussion highlights the firm's unique credentials and their significance in supporting client objectives, emphasizing a commitment to maintaining a highly credentialed team.

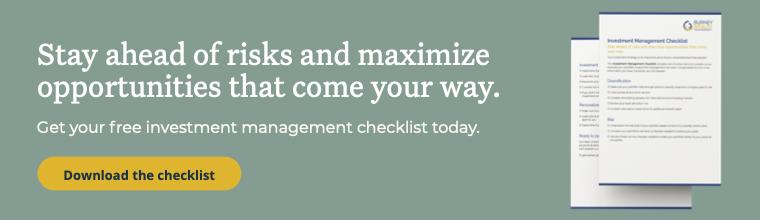

Quarterly Market Summary (03:07)

-

Global Market Performance: Markets globally have shown significant gains, with the S&P 500 experiencing more than a 30% increase from its low back in 2022, reflecting a strong economic recovery and optimistic market sentiment driven by anticipated rate cuts.

-

Shift in Rate Cut Expectations: Initially, the market rallied on expectations of multiple rate cuts starting in early 2024, but recent shifts in economic indicators have reduced these expectations, with possibly one to two rate cuts anticipated before year-end, despite a robust economy.

-

Economic Resilience: The economy has proven resilient, outperforming historical trends even during a rate hiking cycle, leading to strong returns in domestic equity markets and less concern about the reduced likelihood of rate cuts.

-

Challenges in the Bond Market: Investors with heavy allocations in fixed income have faced challenges due to rising rates and falling bond prices, prompting a shift towards diversified and balanced investment models that include alternative asset classes to manage risk and return effectively.

Long-Term Market Summary (07:59)

-

Positive Market Performance: The markets have seen consistent positive returns across all asset classes over the past few quarters, emerging from the tough bear market of 2022, with U.S. equities performing slightly above average over the past decade.

-

International Exposure and Valuation Differences: There is a significant contrast in growth and valuations between the U.S. and international markets, with U.S. stocks showing high growth and valuations, while international stocks exhibit slower growth but cheaper valuations, influencing asset allocation decisions.

-

Diversification Benefits: The diversification benefits of international equities have become more apparent, particularly in the last year, highlighting their role in balanced portfolios amidst market divergences.

-

Market Corrections and Volatility: The stock market has historically experienced regular corrections, including two 5% pullbacks per year on average. The recent corrections and volatility are viewed as normal fluctuations and not necessarily indicative of deeper economic issues.

-

Impact of Reaching All-Time Highs: Reaching all-time highs in the market does not typically signal immediate danger; rather, historical data suggest that markets often continue to perform well after reaching these peaks, with a high probability of positive returns in the following year.

-

Long-Term Market Resilience: Despite the recent volatility and market pullbacks, the overall resilience and strength of the economy support a positive outlook, indicating that these corrections are healthy and normal parts of the market cycle.

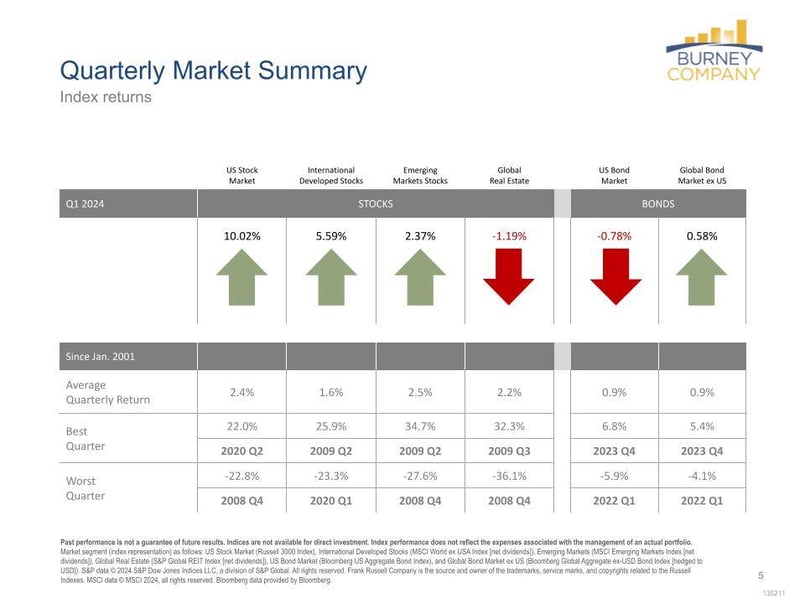

Strong Quarter for Growth, Especially Mid-Growth (16:33)

-

Strategic Positioning: The firm focuses on aligning investment strategies with the size and style phases of the market expected to outperform, such as currently preferring growth over value and small or mid caps over large caps.

-

Current Investment Focus: Currently, the portfolio heavily favors growth sectors and is underweight in large caps, with a significant allocation towards mid and small caps, expecting these segments to offer more investment opportunities.

-

Performance Review: Recent performance data shows that the strategy of leaning into growth and mid-growth sectors has paid off, with strong returns in both large and mid-growth categories over the past quarter and year.

-

Observations on Small Caps: Despite the overall market recovery, small caps have lagged behind, not bouncing back as expected post-sell-off. The firm remains optimistic about potential future performance and continues to monitor this segment for a turnaround.

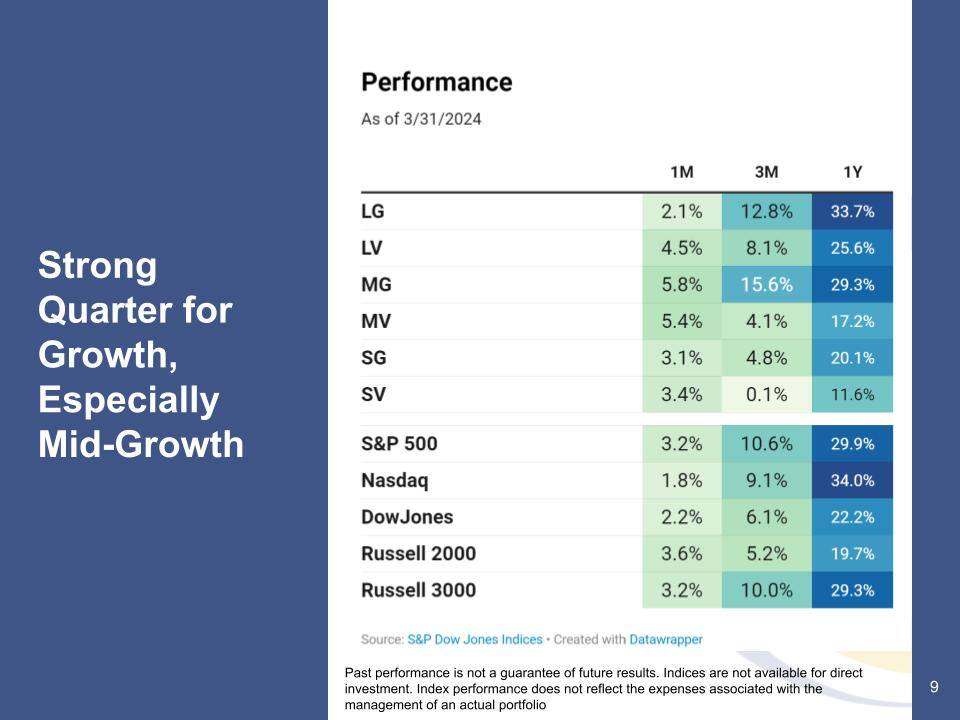

April Drawdown Looks Fairly Uniform (19:08)

-

Recent Volatility Noted: April experienced some volatility, with April 19 marking the lowest point of the month, showcasing significant drawdowns across the market.

-

Impact on Growth Sectors: Growth sectors, particularly in the large and mid cap spaces, faced underperformance during this period; however, it is not enough to shake our confidence that we are in currently in a Growth phase.

-

Market Resilience: Despite the drawdowns, with the NASDAQ and S&P 500 seeing declines of about 7% and 5% respectively, these fluctuations are considered normal, as similar market corrections are expected to occur twice annually on average.

-

Confidence in Investment Strategy: The observed market behavior and sell-off in April, while notable, have not affected the firm's strategic confidence in favoring growth and non-large cap stocks, underscoring a belief in the resilience and potential of these investments.

How the Inflation Picture is Different than 2022 (20:55)

-

Trigger for Sell-off: The recent sell-off in April was partly triggered by a CPI report that came out slightly worse than expected, adding to existing market pressures.

-

Inflation Dynamics: Compared to the crisis-level inflation rates around 9% in 2022, current inflation rates are much lower at around 3.5%. This has led to a different reaction in the stock market, with less severe impacts from inflation announcements.

-

Impact on Small Caps: Small caps have been more adversely affected by inflation data and higher interest rates compared to large caps, primarily because small caps often carry more floating rate debt, which becomes costlier as interest rates rise.

-

Debt Renewal Challenges: Small cap companies face imminent challenges as a significant portion of their debt is due for renewal soon, contrasting with large caps that often have longer maturities on their debt, providing them with more stability in high-interest environments.

-

Goldman Sachs Forecast: Goldman Sachs predicts that core inflation will decrease to 2.2% over the next three quarters, attributing recent spikes to temporary factors like increases in consumer electronics, healthcare, and financial services costs.

-

Market Outlook and Predictions: Although the inflation outlook appears to be improving with expected decreases, uncertainties remain, and the market's response to these developments will continue to be closely monitored, especially concerning small caps' performance.

Investment Committee Declared 'Recovery Phase' Over (26:41)

-

Market Phases and Stock Performance: The stock market is viewed in three phases: normal markets, bear markets, and recovery phases. The firm's stock selection models perform well in normal and bear markets by focusing on quality and safety, which helps stocks perform better during downturns.

-

Challenges During Recovery Phases: Historically, the firm's models have underperformed during market recovery phases, as stocks that were previously less favored outperform those recommended by the model.

-

Adaptation of Models in Recovery Phases: In response to these challenges, the firm developed a recovery model to specifically address stock performance in post-bear market recoveries. This model has shown to be highly effective and is adjusted based on the market's "risk-on" status, not merely returning to previous all-time highs.

-

Current Market Status and Model Adjustment: As of October 2022, the market has been recovering, and it has been approximately 18 months since the bottom. The firm has decided that it is now appropriate to turn off the recovery model based on their assessments and the duration of the current recovery phase.

Recovery Model Normally Outperforms Regular Model During Recovery Phase (29:39)

-

Recovery Model Performance Indicator: The performance of the firm's recovery model is tracked using an orange line on a chart, which compares the performance of stocks recommended by the recovery model against those recommended by the standard model. An upward trend in this line indicates better performance by the recovery model, while a flat or downward trend suggests it might be time to deactivate the recovery model.

-

Variability in Model Effectiveness: The recovery model was highly effective in 2020, significantly outperforming the standard model. However, in the most recent period, the performance was more variable and less consistent than in previous cycles, such as in 2016 and 2020, possibly due to less market panic and more fluctuating market conditions.

Combination of Models Still Proved Effective (30:51)

-

Combination of Models: Although the recovery model alone did not perform as well as historically, it was highly effective when combined with the standard model. This integrated approach takes a 'Venn diagram' strategy, selecting stocks that are highly rated by both models, which has proven to produce significant benefits.

-

Performance Differential: The combined approach of the recovery and standard models significantly enhanced performance, with a differential (delta) of 10% for the standard model alone and 16% when both models were used together, demonstrating strong synergy and effectiveness.

-

Market Environment and Opportunities: Despite the varied effectiveness of the recovery model in different market conditions, the combination with the standard model continues to provide robust stock selection opportunities, especially following major market sell-offs. The firm has now returned to a more normal market environment, yet continues to see strong stock selection opportunities.

Live Q&A (32:15)

- "What's your position on rebalancing equity holdings given the current market?"

- "Is this a good time to buy gold mining companies?"

- "How likely is inflation to fall or grow?"

- "What we look for when we look at long-term growth, like what metrics and data to support those decisions?"

- "Can IRA money be transferred directly to grandchildren before taxed?"

- "So the apparent correction that we're in, how long do we expect it? How severe will it be?"

- "Can you provide an overlay of the recovery model with your other models? What is the true recovery phase or did I miss it?"

- "What is your investment allocation for moderately aggressive investors?"

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.