Financial planning customized to your family’s goals.

Your situation is unique and deserves more than run-of-the-mill advice

Before you ever commit to working with us, we sit down with you, learn about your goals, and create an initial financial plan tailored to you.

Here's a preview of what you can expect to see in your initial financial plan.

Our planning process includes input from credentialed investment, tax, and financial planning professionals:

Click image to enlarge

Click image to enlarge

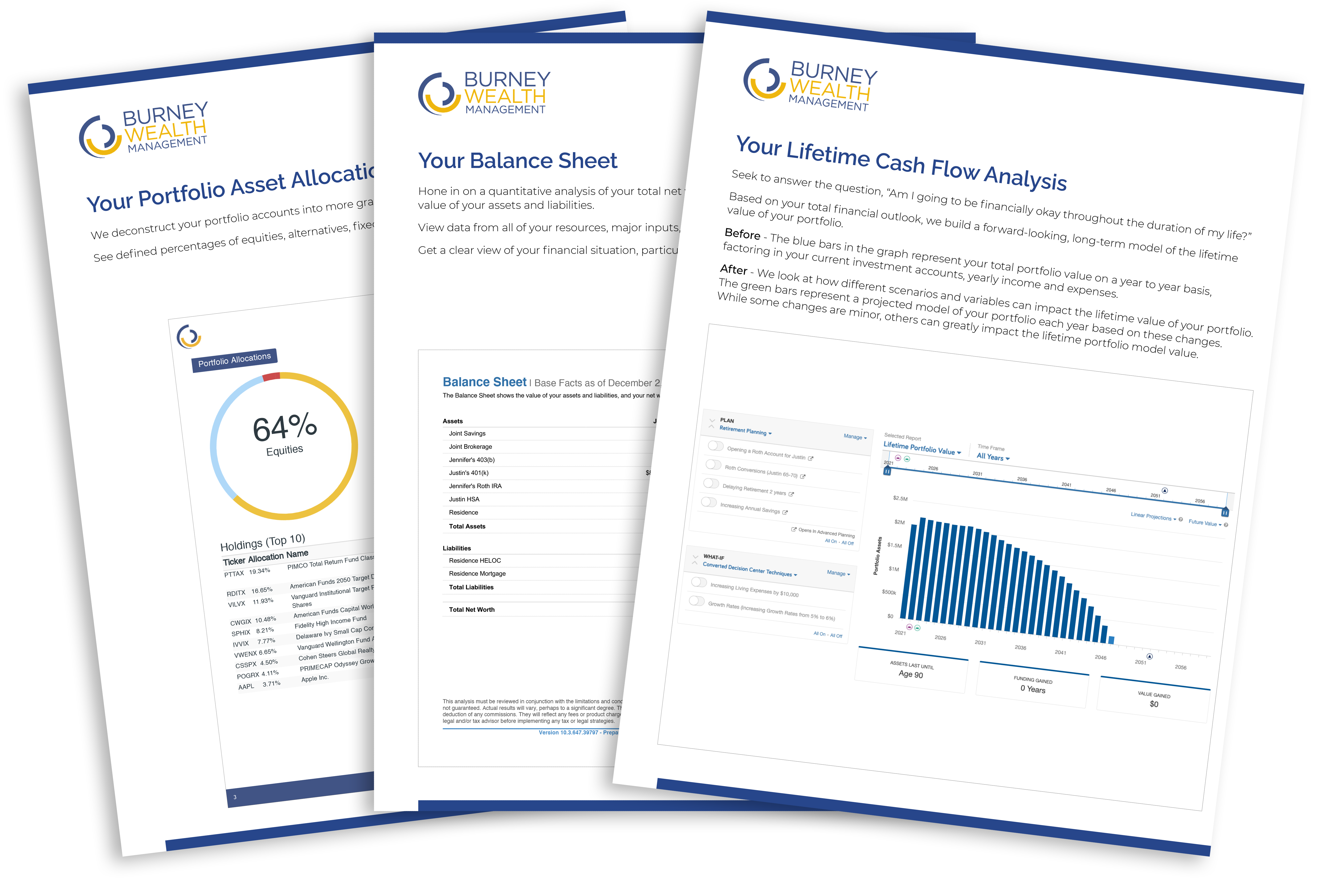

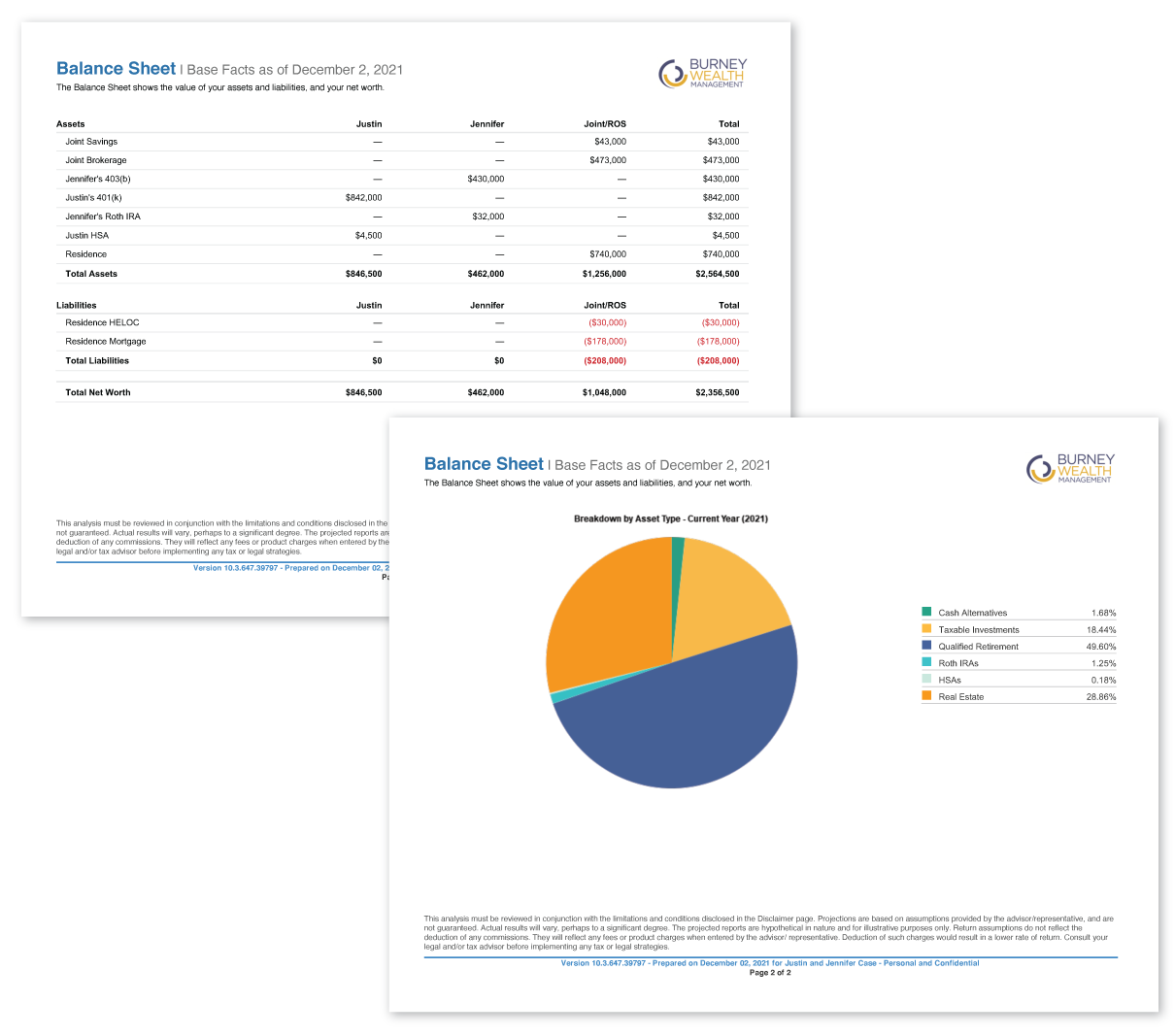

Your Balance Sheet

Hone in on a quantitative analysis of your total net worth, broken down into a visual depiction of the value of your assets and liabilities.

View data from all of your resources, major inputs, and investment accounts for your household.

Get a clear view of your financial situation, particularly the tax treatment of each of

your accounts.

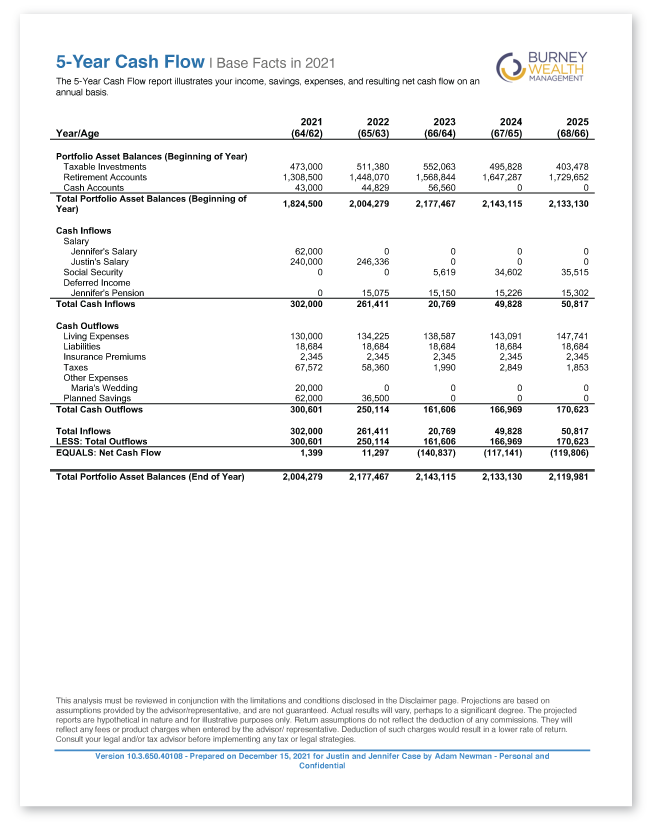

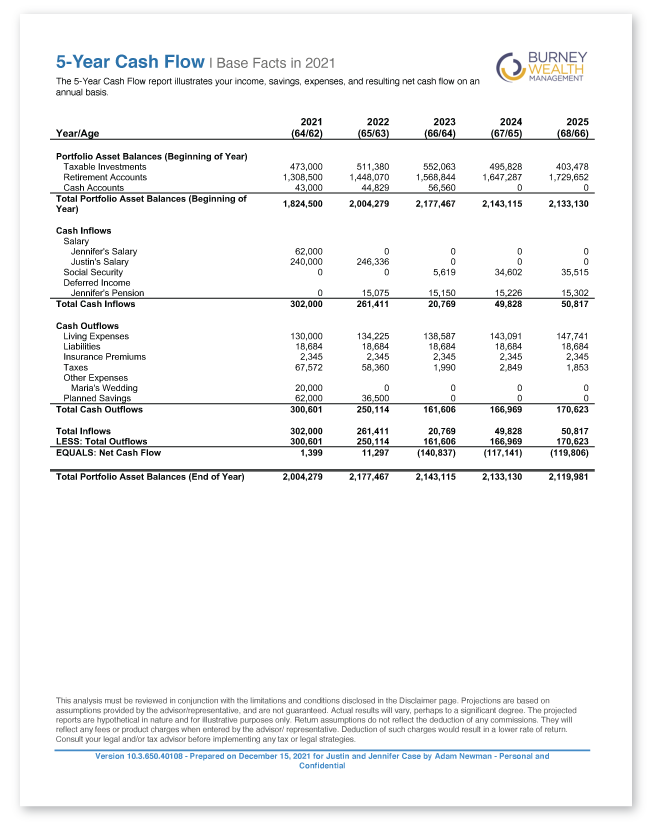

Your Short-Term Cash Flow Analysis

Visualize the next 5 years of your financial life, including your investments, income, savings, and expenses.

While we also help you with forward-looking projections to accomplish your long-term goals, a 5 year window is immediately relevant and impactful.

Depending on your situation, get a real time illustration of the impact of salary changes, additional income sources, new savings opportunities, anticipated tax changes, and insurance updates.

Prioritize where to save and where to cut expenses to achieve short-term and long-term goals.

Click image to enlarge

Click image to enlarge

Click image to enlarge

Click image to enlarge

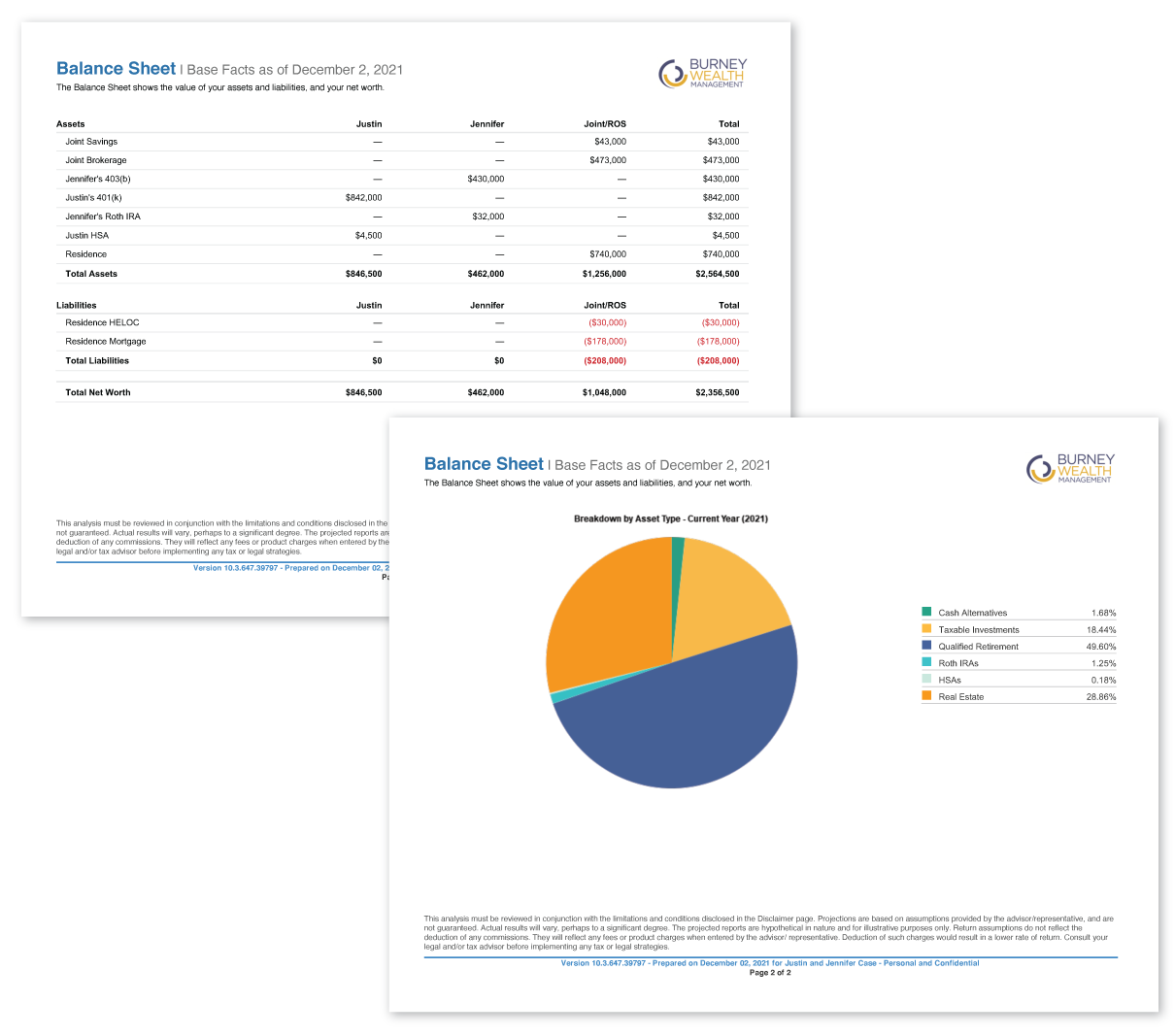

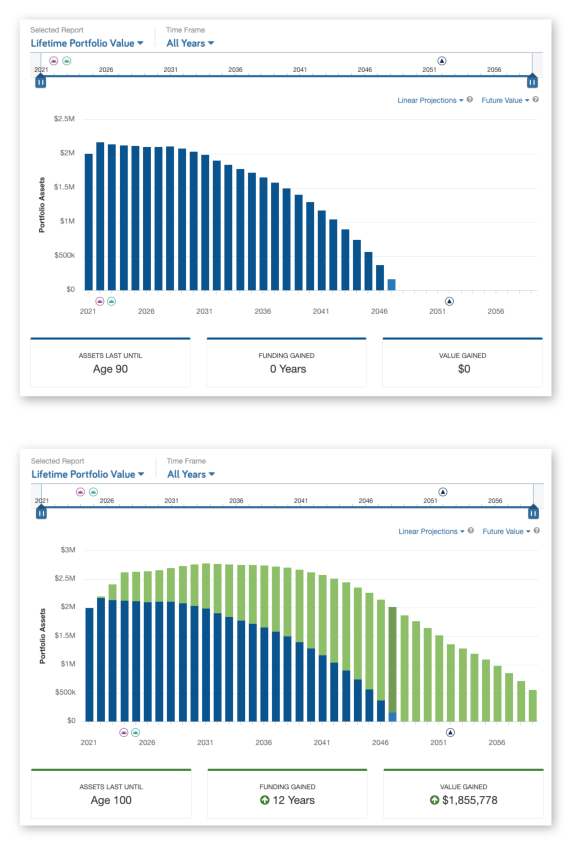

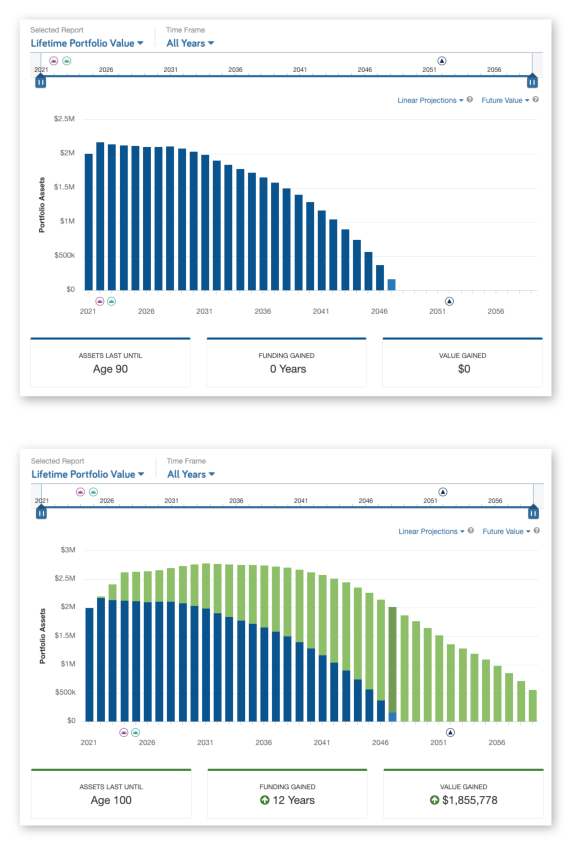

Your Lifetime Cash Flow Analysis

Build a forward looking, long-term model of the lifetime value of your portfolio.

Before

The blue bars in the graph represent your total portfolio value on a year to year basis, factoring in your current investment accounts, yearly income and expenses.

After

The green bars represent a projected model of your portfolio each year based on changing variables and considering potential scenarios. While some changes are minor, others can greatly impact the lifetime portfolio model.

In this example, the projected-green model provides an illustration of suggested changes, including completing a Roth conversion, delaying retirement, and increasing annual savings. It also takes into account an increase in living expenses, anticipated growth, and inflation rates.

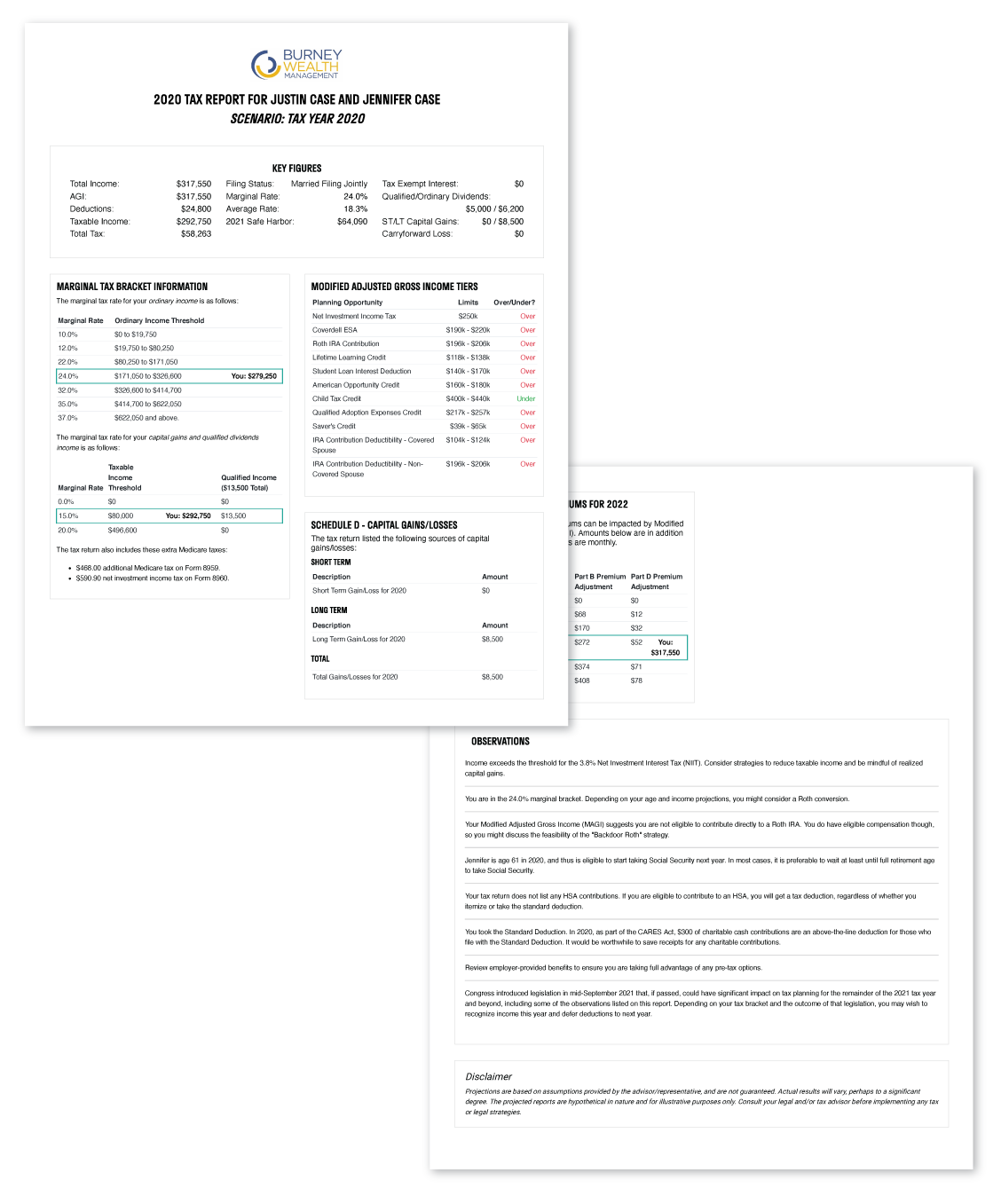

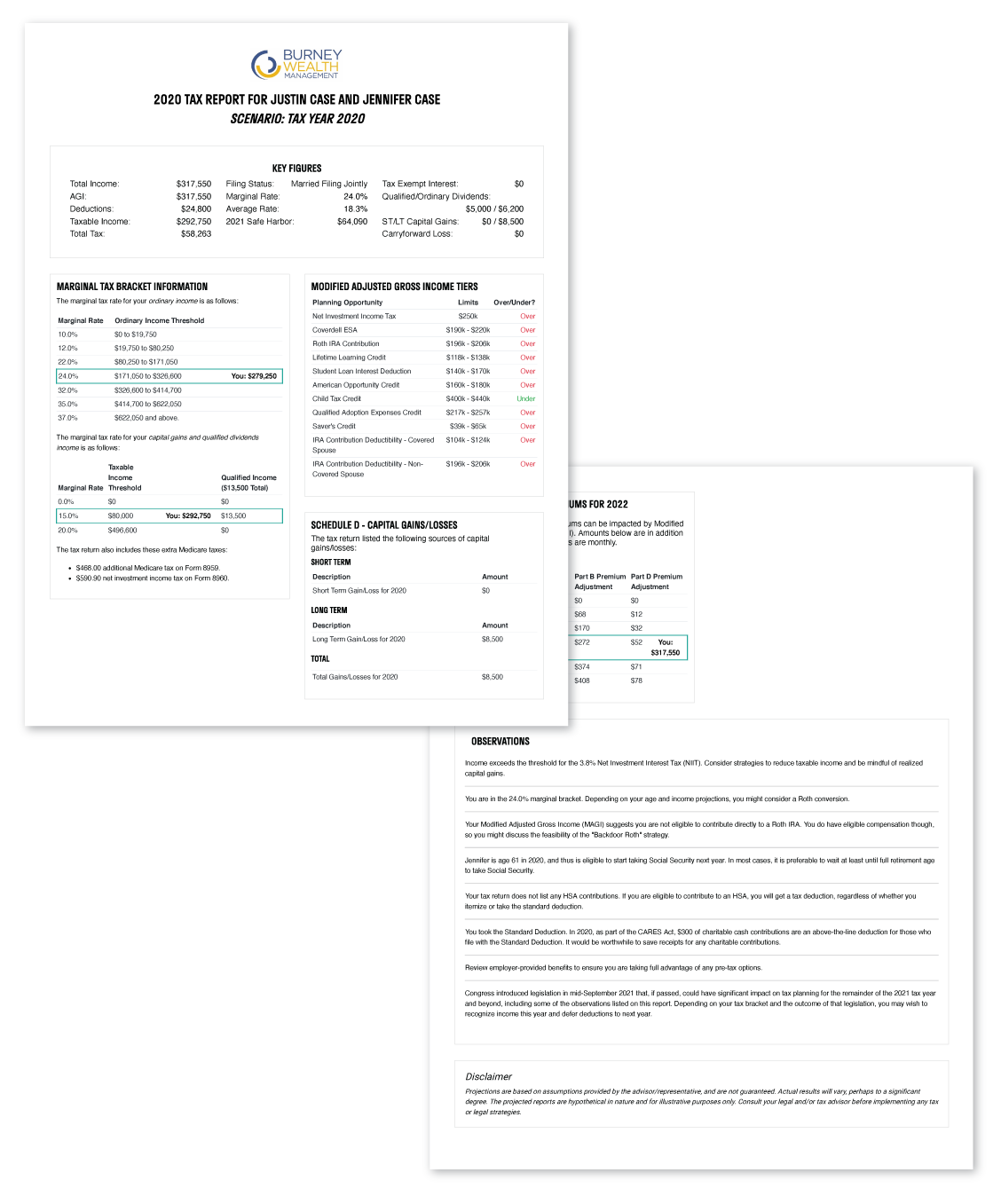

Your Personalized Tax Report

Look at your tax situation in a clear, easy-to-digest format that breaks down your income, tax bracket information, deductions, and capital gains and losses.

Review key insights and discuss tax planning strategies to help you optimize your situation on a year by year basis.

Your personalized tax report is integrated with the Lifetime Cash Flow Analysis, factoring in different “levers” or adjustments, projecting how certain changes can impact your tax situation.

Click image to enlarge

Click image to enlarge

Click image to enlarge

Click image to enlarge

Your Personal Portfolio Analysis

Your custom financial plan now shifts into an analysis of your investment portfolio created by our team of experienced investment analysts.

At Burney Wealth Management, we purposefully choose to review your portfolio investments after building your custom financial plan, not before. Financial planning is your foundation, an essential prerequisite for investment planning.

We help you break down your portfolio into its strengths and weaknesses. From there, we identify areas of opportunity and improvements, all through the lens of your unique financial situation and long-term objectives.

Ready to get started?

Submit the form below, and our team will reach out to schedule a discovery meeting where we'll learn more about you and gather the information needed to build your initial custom financial plan.