Economic & Market Review: Q4 2024 [Webinar Summary]

Presenters: Lowell Pratt, CFA, Andy Pratt, CFA, CAIA, and Adam Newman, CFA, CFP®, MT, RICP®

Here is the webinar recording from January 15th, 2025. You can browse the topics discussed and main takeaways using the sections and time stamps below:

Click the time-stamp in each section title, and you will jump right to that part of the video on a new screen!

- 00:32 - Introduction and Recent Administration Changes

- 03:58 - Q4 Market Performance Overview

- 05:08 - Market Performance Analysis

- 06:39 - Market Implications Discussion

- 10:04 - Political Changes and Market Impact

- 13:40 - The Growth Factor

- 15:26 - The Momentum Factor

- 17:41 - The Stock Selection Factor

- 21:18 - Unusual Small-Caps

- 22:25- Will Small-Caps Break Out?

- 24:56 - Value Stocks Analysis

- 25:56 - Bearish Return Predictions & Concluding Remarks

Introduction and Recent Administration Changes (00:32)

- President-Elect Trump is taking office with an emphasis on implementing Day 1 actions that will impact markets.

- There is particular attention being paid to potential changes in tariff policy under the new administration.

- The market is experiencing a period of uncertainty during this presidential transition period.

- Asset prices have already begun adjusting in response to the election results.

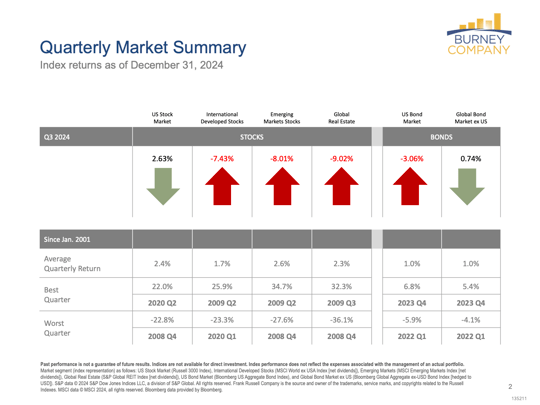

Q4 Market Performance Overview (03:58)

- The market momentum experienced a significant shift at the end of the year.

- The anticipated Santa Claus rally did not materialize as market participants had expected.

- United States equities managed to achieve modest positive gains despite the late-year momentum shift.

- Both global equities and domestic fixed income markets experienced a notable selloff during this period.

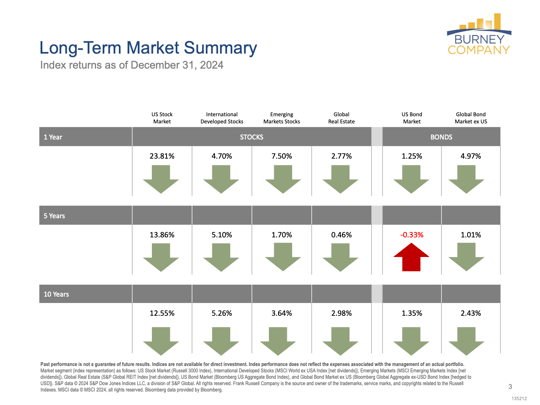

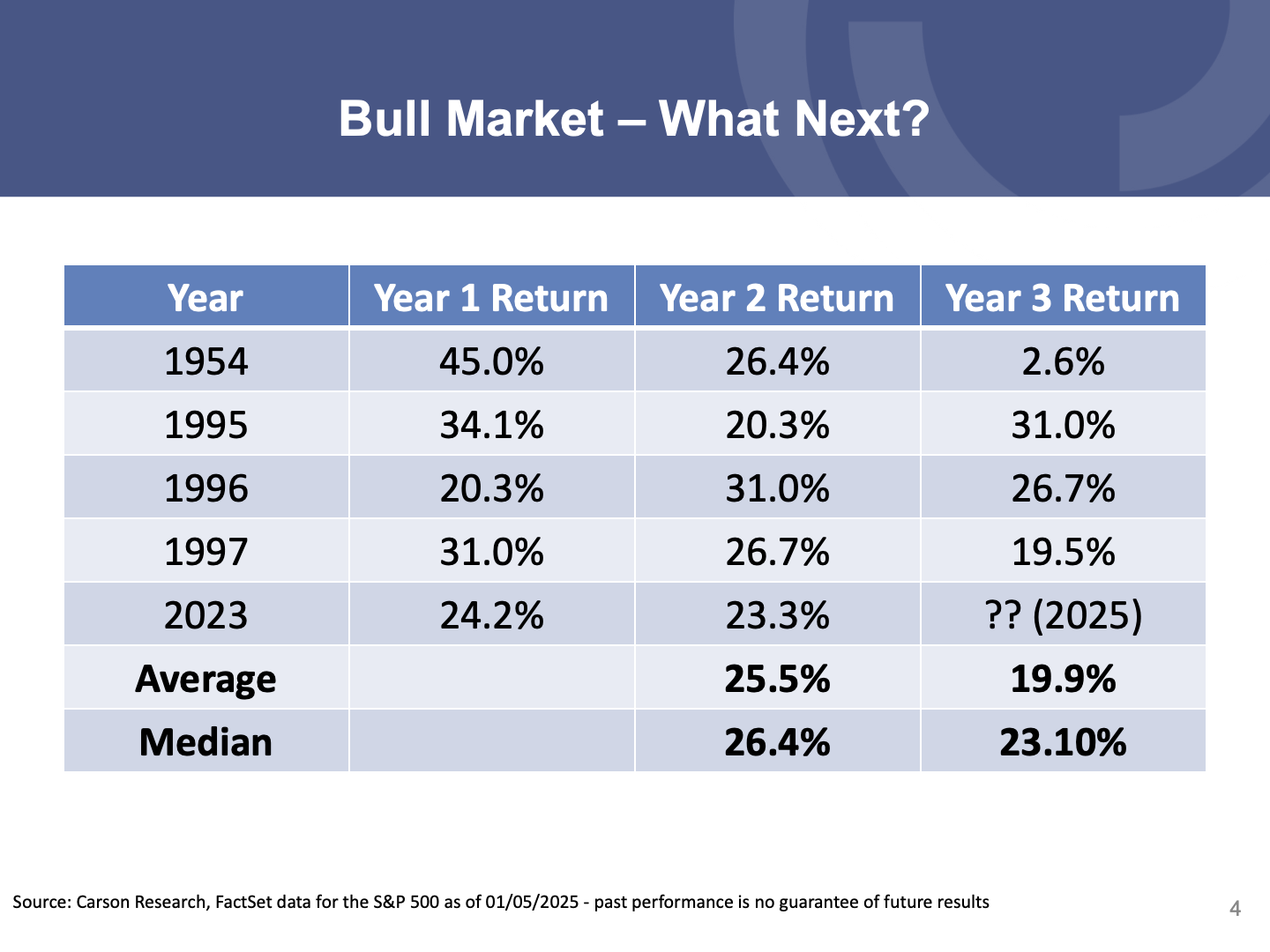

Market Performance Analysis (05:08)

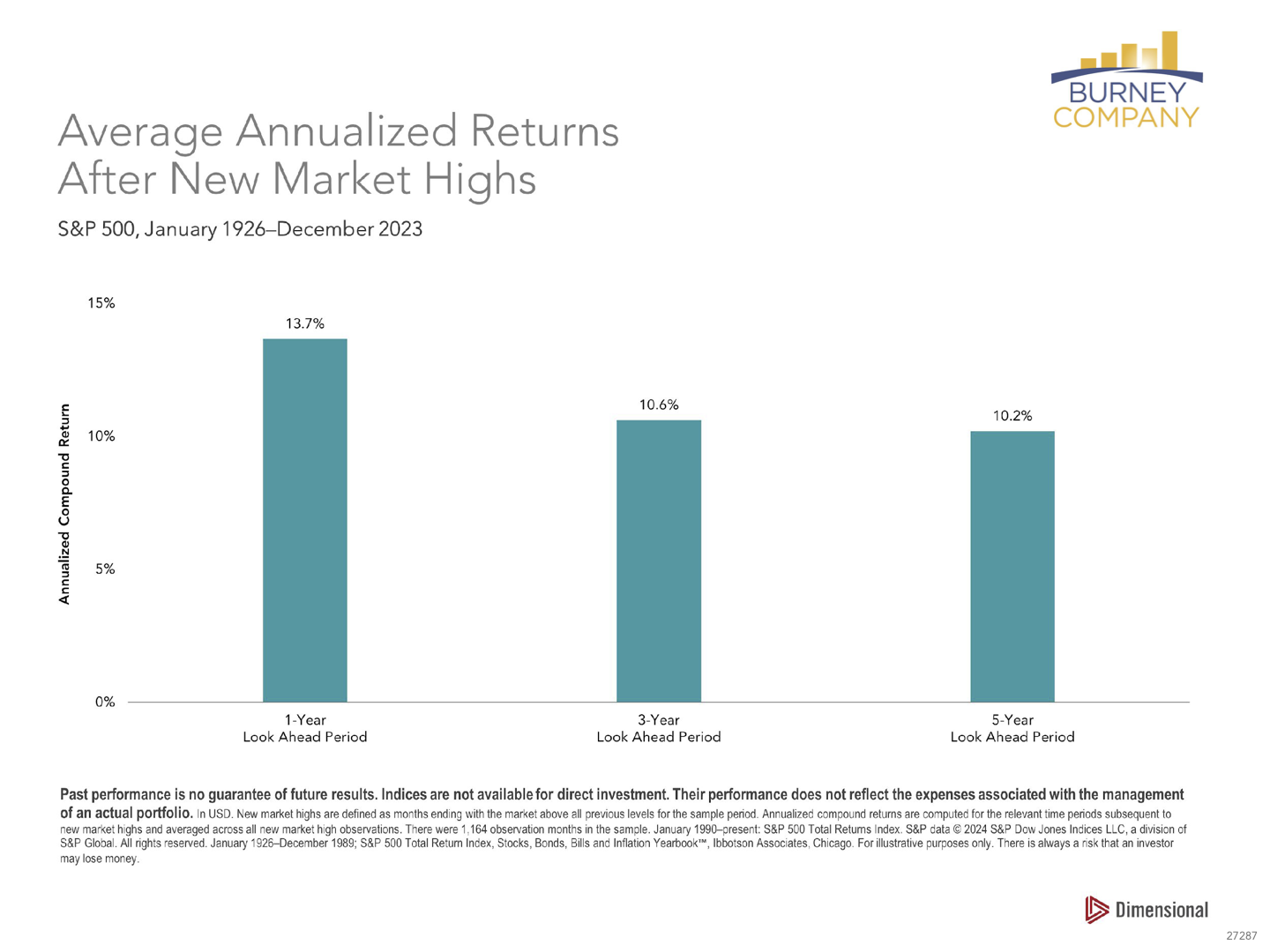

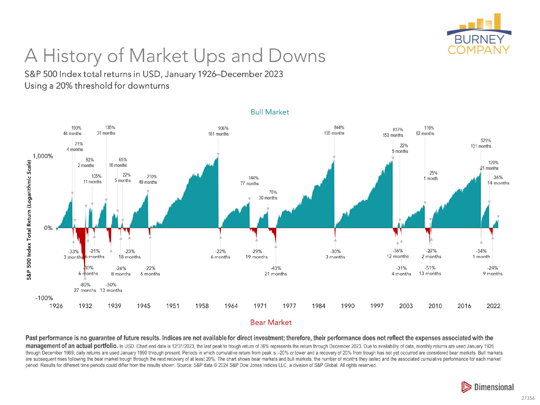

- The market experienced back-to-back years of 20%+ gains, which required careful analysis of historical precedent.

- The team conducted an in-depth examination of the historical context surrounding consecutive years of strong market performance.

- There was extensive discussion regarding the implications of reaching multiple all-time highs during this period.

- The analysis needed to balance both bullish indicators and bearish concerns in the current market environment.

Market Implications Discussion (6:39)

- The Federal Reserve's 50 basis point rate cut in September had significant implications for market behavior.

- The movement of yields was observed across all segments of the market during this period.

- There was a notable disconnect between market expectations and the reality of how events unfolded.

- Inflation concerns remained a prominent factor in market considerations and decision-making.

Political Changes and Market Impact (10:04)

- The analysis thoroughly examined the effects of the administrative transition on market behavior and investor sentiment.

- Market volatility considerations became increasingly important during this period of political change.

- The team placed particular emphasis on examining fundamental economic factors rather than just political headlines.

- A historical perspective on market trends during similar political transitions provided valuable context for current market conditions.

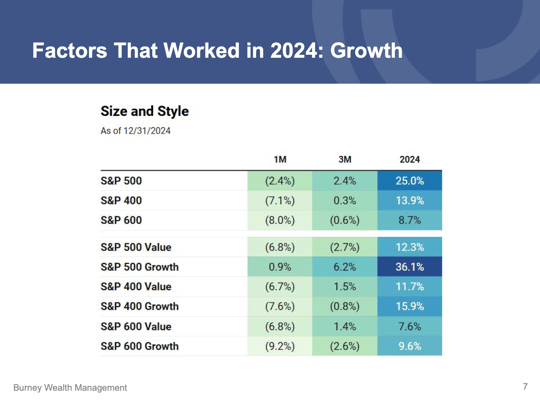

The Growth Factor (13:40)

- The current pro-growth market phase began its trajectory in early 2023, setting the stage for continued momentum.

- Historical analysis shows that growth phases typically maintain their momentum for a period of 18-30 months.

- The market was at the average midpoint for a typical growth phase duration at the time of this analysis.

- The outperformance of growth stocks was not surprising given the prevailing market conditions and historical patterns.

The Momentum Factor (15:26)

- The momentum factor demonstrated even stronger performance than growth stocks throughout 2024.

- Momentum proved its effectiveness as a strategy in both bullish and bearish market conditions.

- There was a clear performance differential between stocks with positive momentum buy signals versus those with sell signals.

- The portfolio construction process actively incorporated momentum signals to optimize investment decisions.

The Stock Selection Factor (17:41)

- Among the top 20 performing stocks, only one member of the Magnificent 7 (Nvidia) made the list, challenging common market narratives.

- The energy and industrial sectors demonstrated strong performance, contributing significantly to market returns.

- The technology sector showed expanded breadth beyond the mega-cap stocks that typically dominate headlines.

- The model's buy and sell signals produced a significant 9.4% performance differential, indicating strong stock selection effectiveness.

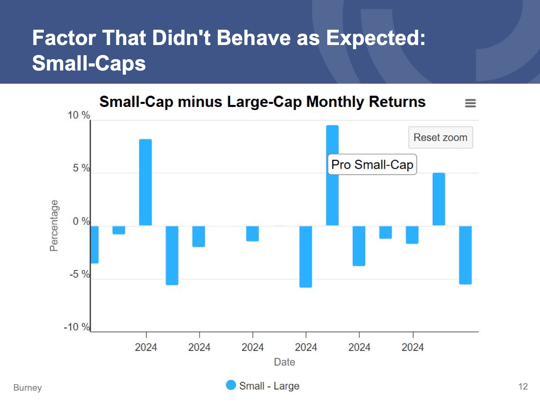

Unusual Small-Caps (21:18)

- The market experienced periodic strong pro-small cap rallies throughout 2024, showing interesting but inconsistent patterns.

- Notable performance spikes were observed specifically during July and November of the year.

- Despite initial strong momentum in these rallies, the enthusiasm typically fizzled out after the initial surge.

- Small-cap performance showed particular sensitivity to inflation news and Federal Reserve policy announcements throughout the year.

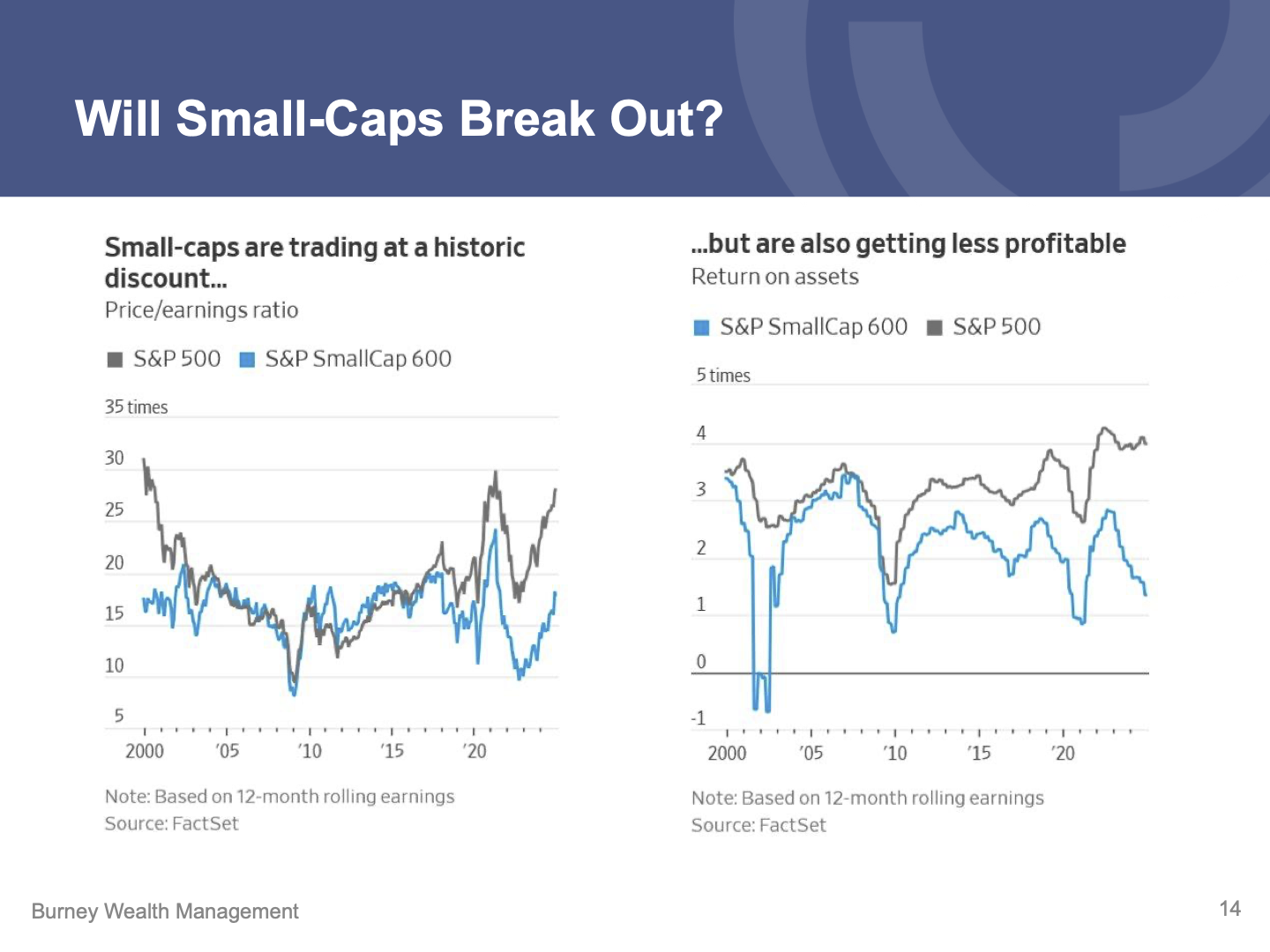

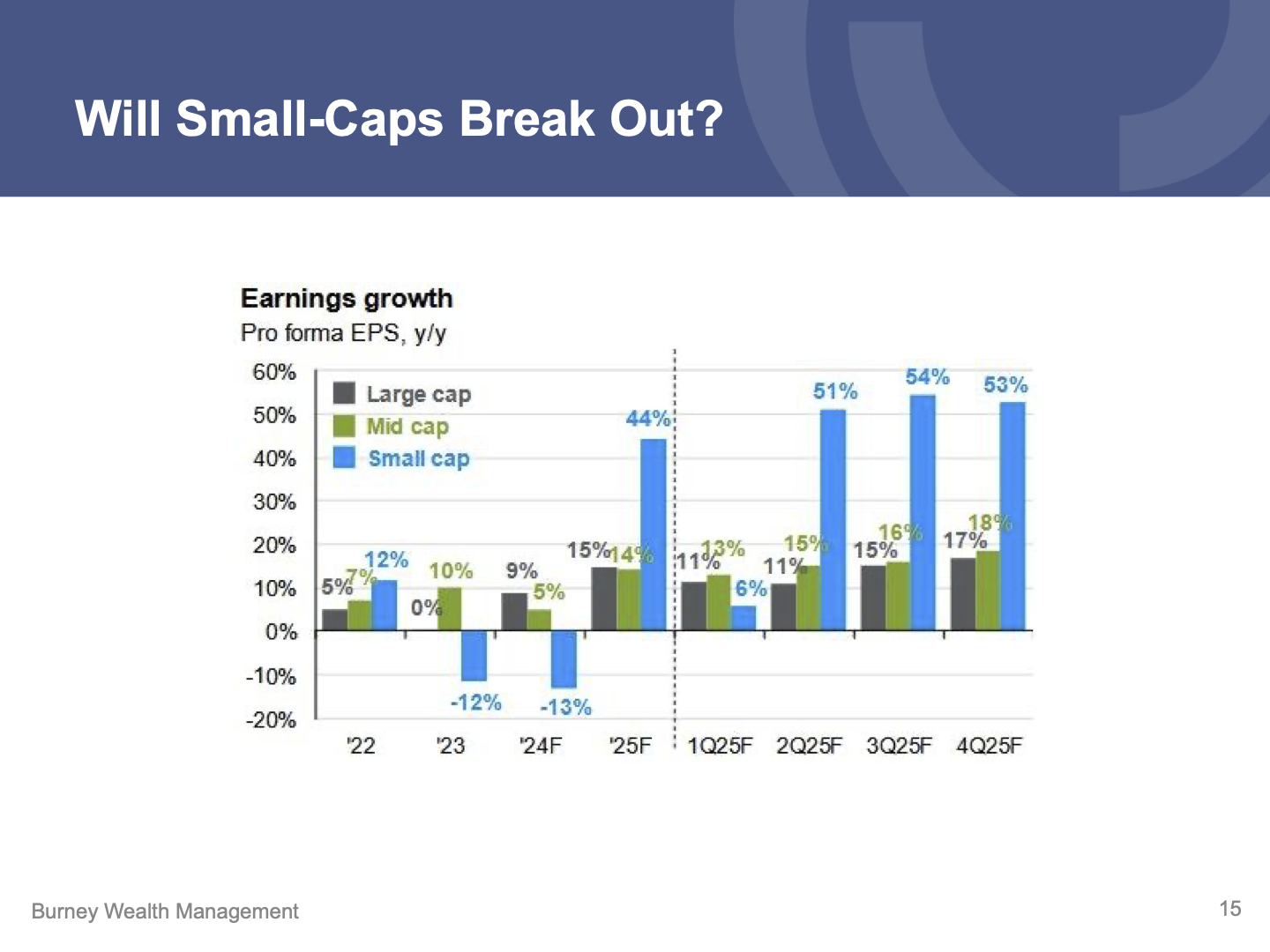

Will Small-Caps Break Out? (22:25)

- Small-cap valuations were trading significantly cheaper compared to their large-cap counterparts during this period.

- Ongoing profitability concerns continued to affect small-cap performance and investor confidence.

- The market was actively waiting for confirmation of an earnings per share breakout in the small-cap sector.

- Market analysts expressed strong expectations for a robust small-cap recovery in 2025.

Value Stocks Analysis (24:56)

- The market began showing growing value momentum during November, indicating a potential shift in market dynamics.

- The team responded by reducing their maximum growth positioning in portfolios to adjust to these emerging trends.

- Clear signs of market broadening were emerging, suggesting a potential shift in leadership.

- Analysis indicated that a value phase could materialize as a dominant market theme in 2025.

Bearish Return Predictions & Concluding Remarks (25:56)

- Major financial institutions, including Goldman Sachs and Vanguard, were forecasting relatively low annualized returns of around 3% over the next decade, particularly in large-cap stocks.

- Market concentration and valuations had reached record levels, suggesting a challenging environment ahead for traditional portfolio strategies.

- Analysis indicated that higher return potential existed in mid-cap and small-cap market segments, offering opportunities for active investors to generate alpha.

- Alternative investment strategies were gaining increased importance as traditional return expectations faced significant headwinds.

- Portfolio diversification and broader market exposure were becoming critical factors for optimizing future returns in this challenging environment.

CNBC’s annual FA 100 ranking was published on 10/2/2024 for the year 2024. The Burney Company did not pay CNBC any compensation for being considered for the list, however, Burney Company does pay a licensing fee to use the CNBC logo in marketing materials. A link to the CNBC selection criteria can be found by going to https://cnb.cx/3Pg6FVh. The CNBC award was given to The Burney Company, the parent company which encompasses nine other Affiliated Portfolio Managers, and not Burney Wealth Management.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.