How the CARES Act Applies to You: Individuals (Part 1)

In the wake of COVID-19, “social distancing” has taken precedent, leading to reduced revenue for businesses and skyrocketing unemployment.

Agencies are responding to help the American people the best they can. The IRS pushed the tax-filing deadline to July 15, 2020 and, more importantly, Congress passed a massive $2 Trillion emergency financial stimulus package. The Coronavirus Aid, Relief and Economic Security (CARES) Act of 2020 is designed to assist the millions of Americans who are suffering due to the COVID-19 outbreak.

In Part 1 of our two part series on the CARES Act, we will review the list of provisions you should be aware of as an individual. Part 2 will cover the parts of the bill relevant to small businesses.

- Recovery Rebates – Direct payments to taxpayers.

- Student Debt relief

- 2020 Required Minimum Distributions

- Enhanced loan rules for qualified retirement plan distributions

- Charitable gifting

- Healthcare

Recovery Rebates

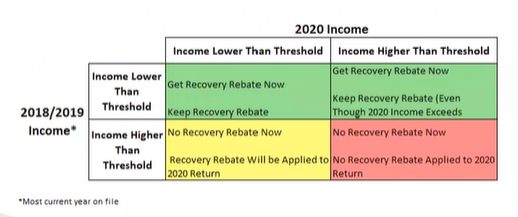

One of the most significant provisions of the CARES Act are the direct payments being distributed to taxpayers. The adjusted gross income (AGI) phaseout is based on 2018 or 2019 tax returns (depending on which is more up to date) and varies depending on tax filing status.

How much will I get?

Income limits:

- Single: $75,000

- Head of Household: $112,500

- Married Filing Jointly: $150,000

To start, each single taxpayer will receive a one-time $1,200 payment and each married couple will receive a one-time $2,400 payment. Each child under the age of 17 will add an additional $500.

There is a phase out of $5 per $100 of additional income over the given thresholds. Payments will decrease until it stops altogether for single taxpayers earning $99,000 or married people who have no children and earn $198,000. According to the Senate Finance Committee, a married couple with two children will not be eligible for a payment if their combined income is above $218,000. Individuals with $0 of income are eligible for payment, provided they are not a dependent of another taxpayer and have a work-eligible Social Security Number.

Do payments count as income to the recipient?

No, the rebate is treated like other refundable tax credits, such as the child tax credit and earned income tax credit, and is not considered income. Additionally, if the credit amount you qualify for based on 2020 income is less than what you qualify for based on your 2019 tax return, it does not have to be paid back.

High earners in 2019 who recently lost their job due to COVID-19 will not receive immediate assistance, but they will get some relief when they file their 2020 tax returns.

Note: If you fell under the income threshold in 2019, but not in 2018, we strongly recommend filing your 2019 taxes ASAP in order to qualify for the direct payment.

How will I get it?

Social security recipients not enrolled in direct deposit will receive their payments when they get their social security checks. If you have direct deposit on file with the IRS (i.e. direct deposit for your tax return), it will go to the last known direct deposit account. All others will receive a check in the mail. There will be a notice sent out with information and a phone number to call if there is a problem receiving payments.

Student Loans

There are provisions added to the bill that give relief to student loan payments and education grants.

Relief for borrowers

Federal Student Loan payments are deferred until September 30, 2020, and no payments are required until then. In addition, no interest will be accrued during the interim. This will still count toward loan forgiveness programs. This one is important: PAYMENTS WILL NOT STOP UNLESS REQUESTED.

What can employers do to help their employees with student loans?

In combination with existing employer tuition assistance programs, employers can now pay up to $5,250 to employees for the purpose of paying down student debt. These payments will be excluded from employee income. Please note that this only applies to 2020.

Pell Grant/Subsidized Loan Relief

If a student drops out of school due to coronavirus, the loan/grant is eliminated for Spring Semester 2020.

Coronavirus-Related Distributions

How does this affect retirement account distributions?

2020 Required Minimum Distributions

Congress waived all Required Minimum Distributions for 2020. This applies to all RMD required accounts, including Inherited “Stretch” IRAs. If you turned 70 ½ in 2019 but put off taking your 2019 RMD until April 2020, therefore requiring you to take both RMDs in 2020, then both RMDs are waived.

If you already took your 2020 RMD, that’s ok! You are allowed to return your unwanted or unneeded RMDs back to the account. However, this does not apply to inherited IRAs and the 60-day rollover rules applies. If you fall outside the 60-day window, then you likely fall under “Coronavirus-related distributions.”

Coronavirus-related Distributions

Essentially, if you have been affected by COVID-19 in any way, you are eligible for the “Coronavirus-related Distributions” provision. This includes; you, your spouse, or a dependent being diagnosed with COVID-19, financial consequences from being quarantined, furloughed, laid off, or having reduced work hours due to COVID-19, being unable to work due to loss of childcare, owning a business that closed or has to operate under state/federal mandated reduced hours, etc. The IRS is expected to take a broad view of what it means to have been “affected.”

What does the provision include? You are allowed to distribute up to $100,000 from a qualified plan or IRA to help with needed income during 2020. As a result, the IRS declared that these distributions will:

- No longer be subject to a 10% early withdrawal penalty (59 ½ rule)

- Not be subject to Mandatory Withholding Requirements (usually 20%)

- Be eligible to be repaid over 3 years – you can roll the entire distribution, or any portion of it, back into the retirement account. Amended returns are preferred to be filed to claim a refund.

- Be recognized over 3 years. You will not have to recognize $100,000 of income in 2020, you can spread it over 2020, 2021, 2022 if you want.

Enhanced Loans from Qualified Plans

Previously you could only borrow 50% of your vested qualified plan value, up to $50,000. The CARES Act, however, has increased the loan amount to 100% of the vested value, up to a maximum of $100,000. If you currently have a loan out, payments are suspended for one year.

Qualified Charitable Contributions

There is an added $300 above-the-line deduction for Qualified Charitable Contributions, as long as they’re made in cash to a 501(c)(3) charity. Donations to a donor-advised fund do not qualify and cannot be itemized deductions on a tax return. The CARES Act also expands itemized charitable deductions made in 2020. AGI limit has been temporarily repealed for cash contributions made to a 501(c)(3) charity.

Healthcare Provisions

The CARES Act includes over $100B in funding for the Health Care provision. Most notably, certain definitions have been updated.

Qualified Medical Expenses

Part of the CARES Act now allows for expenses from Health Savings Accounts (HSA), Archer Medical Savings Accounts (MSA), and Healthcare Flexible Spending Accounts (FSA) to be used for over-the-counter medications.

Medicare Specific Provisions

- Medicare beneficiaries will be eligible to receive the COVID-19 vaccine, when it becomes available, at no cost.

- Those on Medicare Part D have the ability to request up to a 90-day supply of medication.

Overall, the CARES Act of 2020 is packed with relief for individual taxpayers and small business owners during this economic roller-coaster. What’s important to remember is that laws are constantly changing to adapt to unfolding scenarios. The best thing you can do is seek opportunities with these new laws and take advantage of existing laws before they change

Summary of changes and opportunities for individuals in 2020.

- You will get a payment from the government even if you owe back-taxes.

- 2020 RMDs are suspended – if you don’t need the income, reinvest it back in the market. Stocks are cheap!

- AGI limit lifted for 501(c)(3) charities – if you can, consider donating more, increasing the amount you can write off on taxes.

- Traditional and ROTH IRA contribution deadlines are pushed back to July 15, 2020.

- Federal Student loan payments (principal and interest) deferred until September 30,

- MSA/FSA/HSA now cover over-the-counter drugs.

- Medicare beneficiaries will get COVID-19 Vaccine for free.

- Loans from qualified plans have doubled.

There has never been a better time to review your financial plan or to create a new plan than today. Speak to your advisor about what opportunities may be available to you.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.