Q4 2025 Economic & Market Review [Webinar Recording]

Presenters: Andy Pratt, CFA, CAIA and Adam Newman, CFA, CFP®

Here is the webinar recording from January 21, 2026. You can browse the topics discussed and main takeaways using the sections and time stamps below:

- 00:00 - Introduction

- 01:45 - Q4 Market Performance Overview

- 05:12 - Sector Performance and Market Breadth

- 07:00 - What Drives Stock Returns: Earnings

- 09:21 - Bull Market Context and Investor Sentiment

- 13:32 - US Equity Strategy Updates

- 20:42 - Large-Cap vs. Small-Cap Style and Size Update

- 29:22 - Deep Dive Q&A

Click the time stamp in each section title to jump to that part of the video on a new screen.

Introduction (00:00)

- Andy and Adam presented the first quarterly economic and market review webinar of 2026, with Lowell absent while recovering from knee replacement surgery on Friday.

- The webinar was recorded on January 21, 2026, the day after the market experienced its first negative 1% down day of the year and the worst day since October 2025.

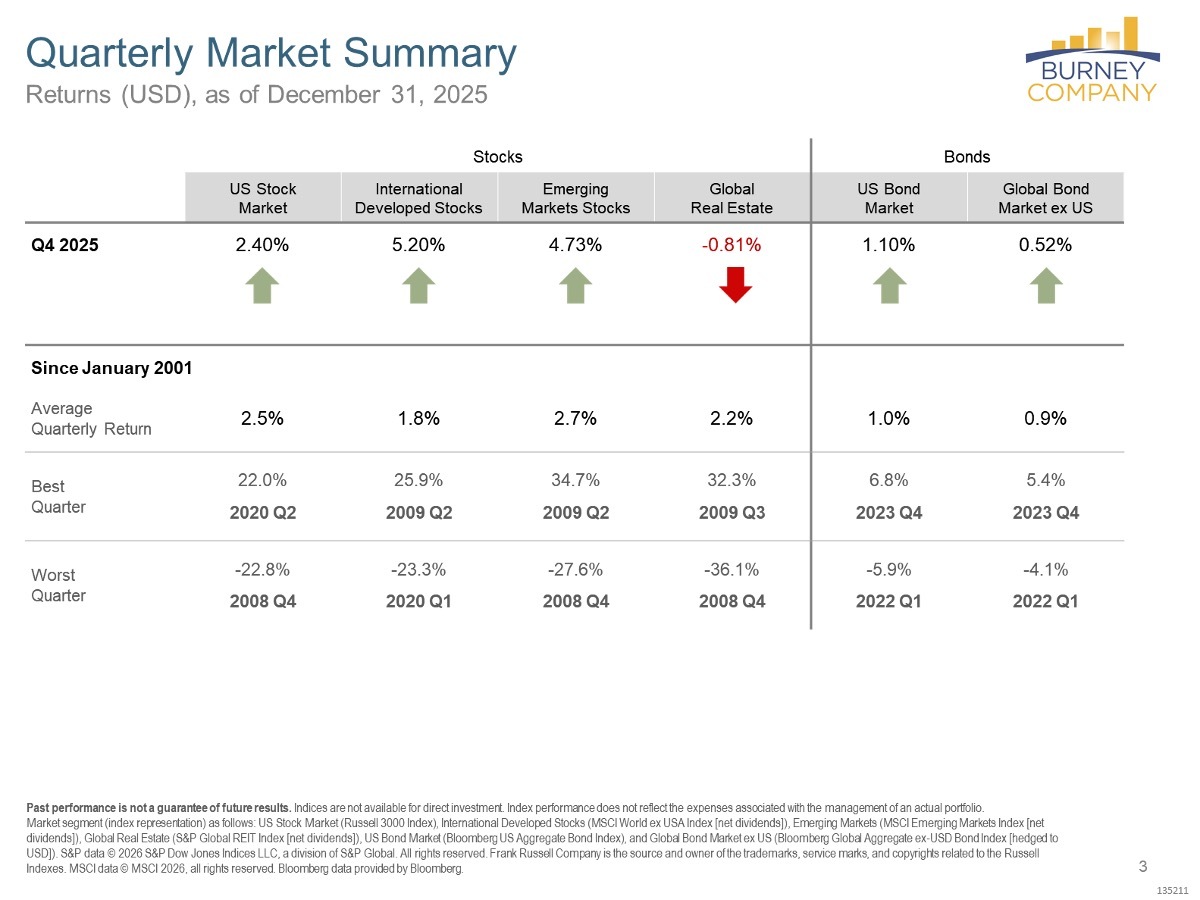

Q4 Market Performance Overview (01:45)

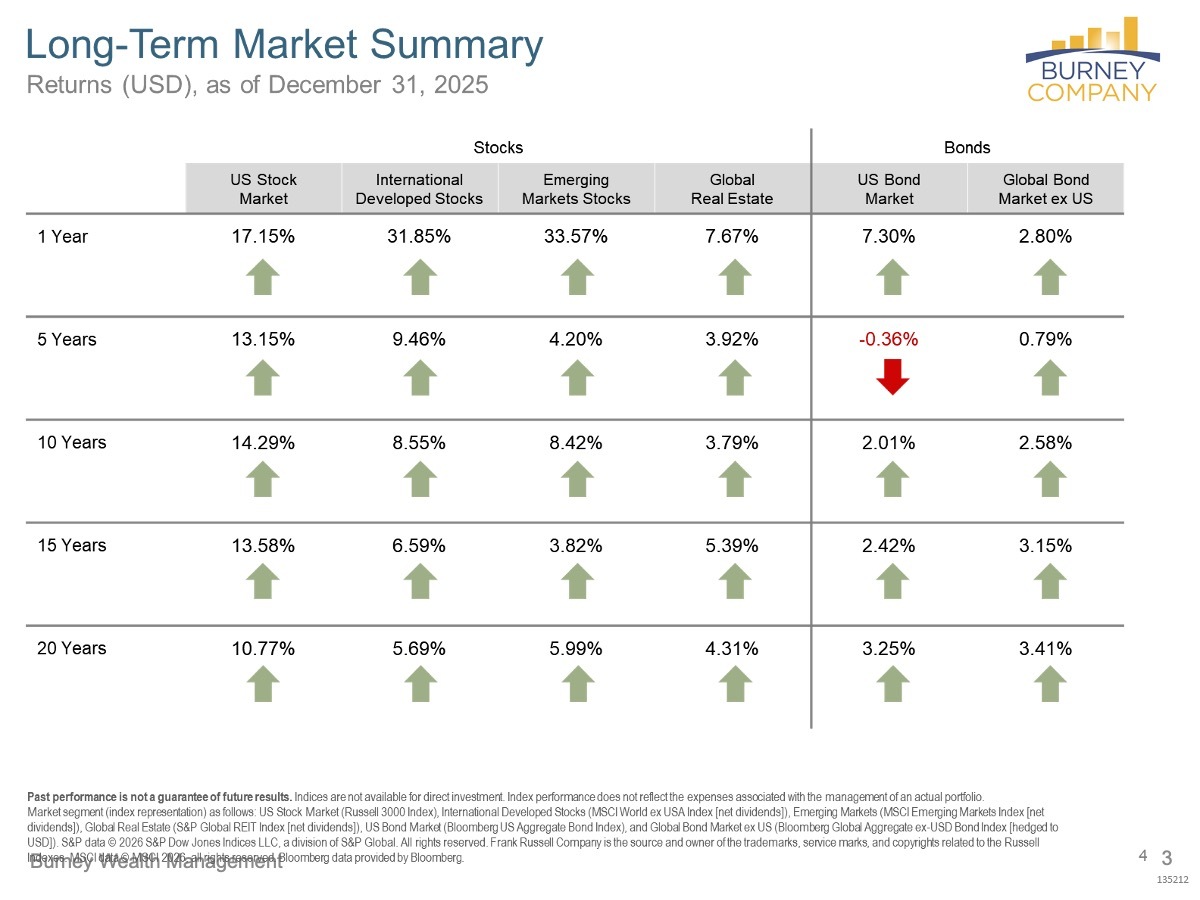

- Q4 2025 showed modest returns with US stocks up about 2.5%, continuing the theme of international markets leading the way as both developed and emerging markets outperformed.

- For the full calendar year 2025, this marked the third consecutive year of double-digit equity returns, with international stocks posting a banner comeback year up over 30%.

- The US bond market had a strong year, up 7%, while global bonds were slightly weaker, providing a reminder of why diversification matters in balanced portfolios.

- Fixed income normalized back to mid-single digit return levels after 2022's historic selloff, demonstrating that bonds still have a role in diversified portfolios.

- International markets showed remarkable resilience during April's tariff tantrum, barely falling 10% while US stocks dropped nearly 20%.

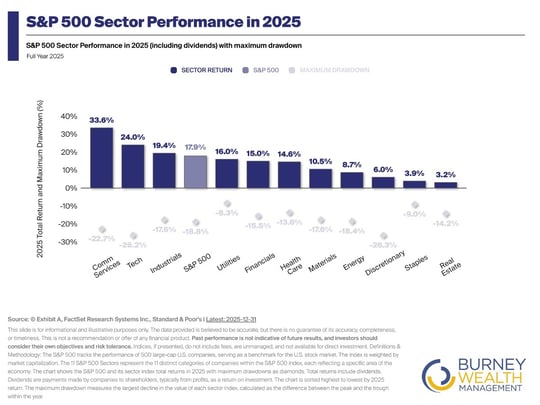

Sector Performance and Market Breadth (05:12)

- Last year saw strong broadening in market performance beyond just the Magnificent Seven, with financials, healthcare, and industrials performing well from both a performance and earnings growth perspective.

- Tech and tech-heavy sectors did well, but the rally was not concentrated to only a few companies as some feared.

- All sectors experienced meaningful intra-year volatility, with tech suffering a nearly 30% drawdown during April's tariff tantrum.

- Earnings and performance were strong across all sectors, challenging the narrative that we're in a concentrated bubble.

- The market breadth demonstrates this was not just an AI-driven rally but a fundamentally supported broad market advance.

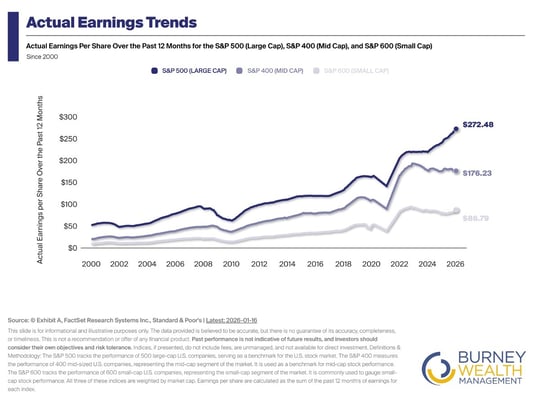

What Drives Stock Returns: Earnings (07:00)

- Earnings continue to improve across the board, with even an acceleration in small-cap earnings recovery becoming visible.

- What drives stock returns over time is earnings, not headlines or daily noise.

- Looking at GDP, the consumer, and falling inflation, there are many positive indicators beyond just stock prices.

- Q3 GDP beat expectations strongly, and Q4 projections also exceeded expectations despite talk of a weakening or flattening economy.

- The actual earnings trend, coupled with economic growth, makes a strong case for continued optimism about general economic conditions.

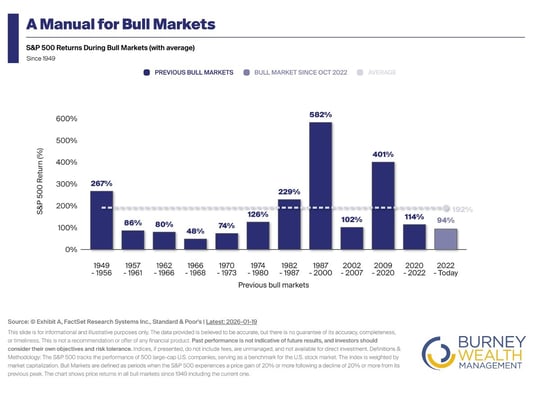

Bull Market Context and Investor Sentiment (09:21)

- Coming off the October 2022 bottom, the current bull market is up about 94%, which is below the historical average bull market return of 192%.

- Bull markets since the 1970s have lasted longer in both duration and performance compared to earlier periods.

- This feels like one of the most hated bull markets, with widespread caution and concern despite strong economic conditions creating a disconnect between investor sentiment and actual performance.

- The current bull market is in the middle innings when compared to historical bull markets, not overstretched in terms of time or return.

- Patient investors who stayed calm through 2025's volatility, especially in April, were ultimately rewarded.

US Equity Strategy Updates (13:32)

- Large growth once again won in 2025, with the Magnificent Seven (formerly FANG stocks) continuing their dominance, though value showed a slight edge in Q4 across all market caps.

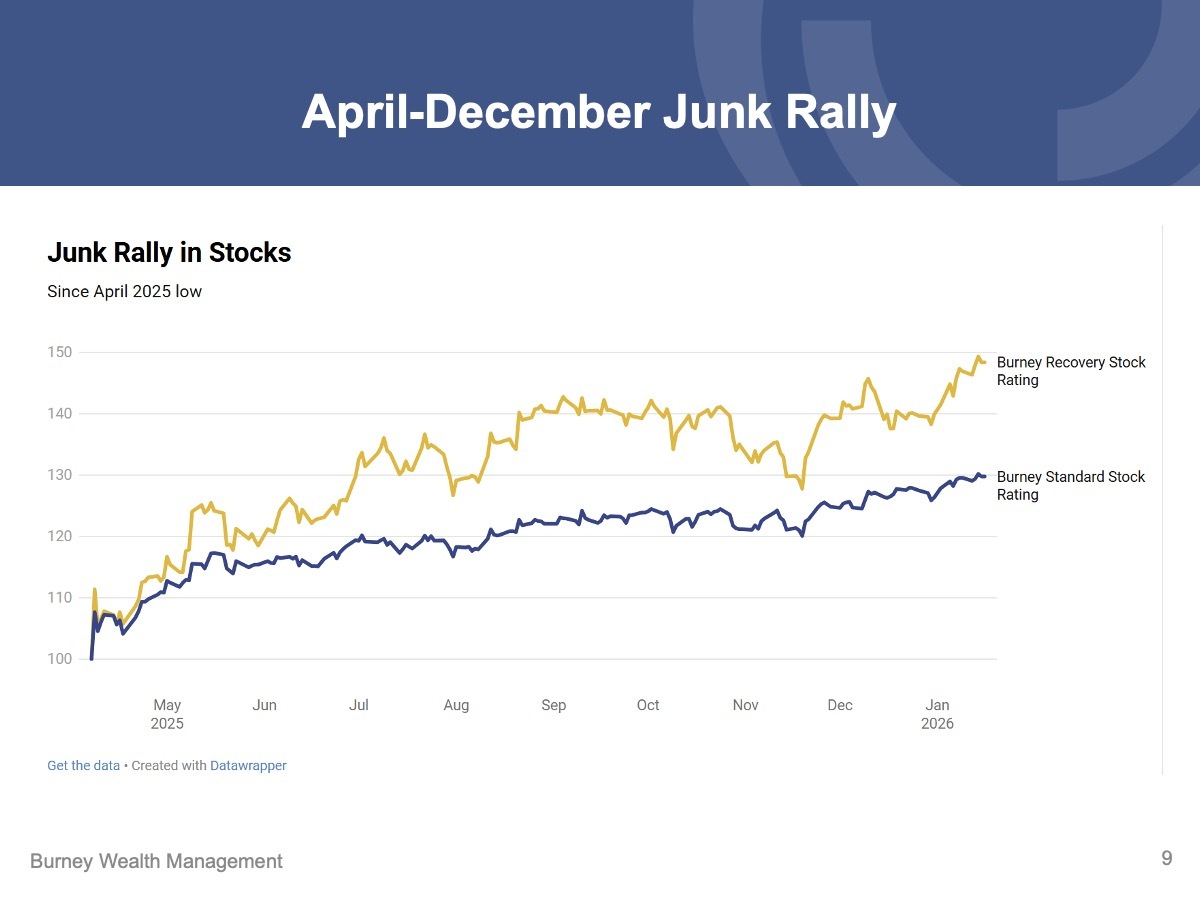

- The Russell 2000 was up nearly 13% for the year, but S&P's mid and small cap indexes showed only single-digit returns due to a critical difference: S&P requires companies to be profitable.

- A strong "junk rally" occurred in lower-quality stocks coming out of April's lows, with unprofitable companies up about 50% versus 30% for high-quality stocks.

- The junk rally is expected to be short-lived and highly volatile, as these lower-quality stocks show extreme swings rather than the consistent performance of profitable companies.

- The recovery rating was not turned on because the near-bear market in April was very short-lived and reversed quickly.

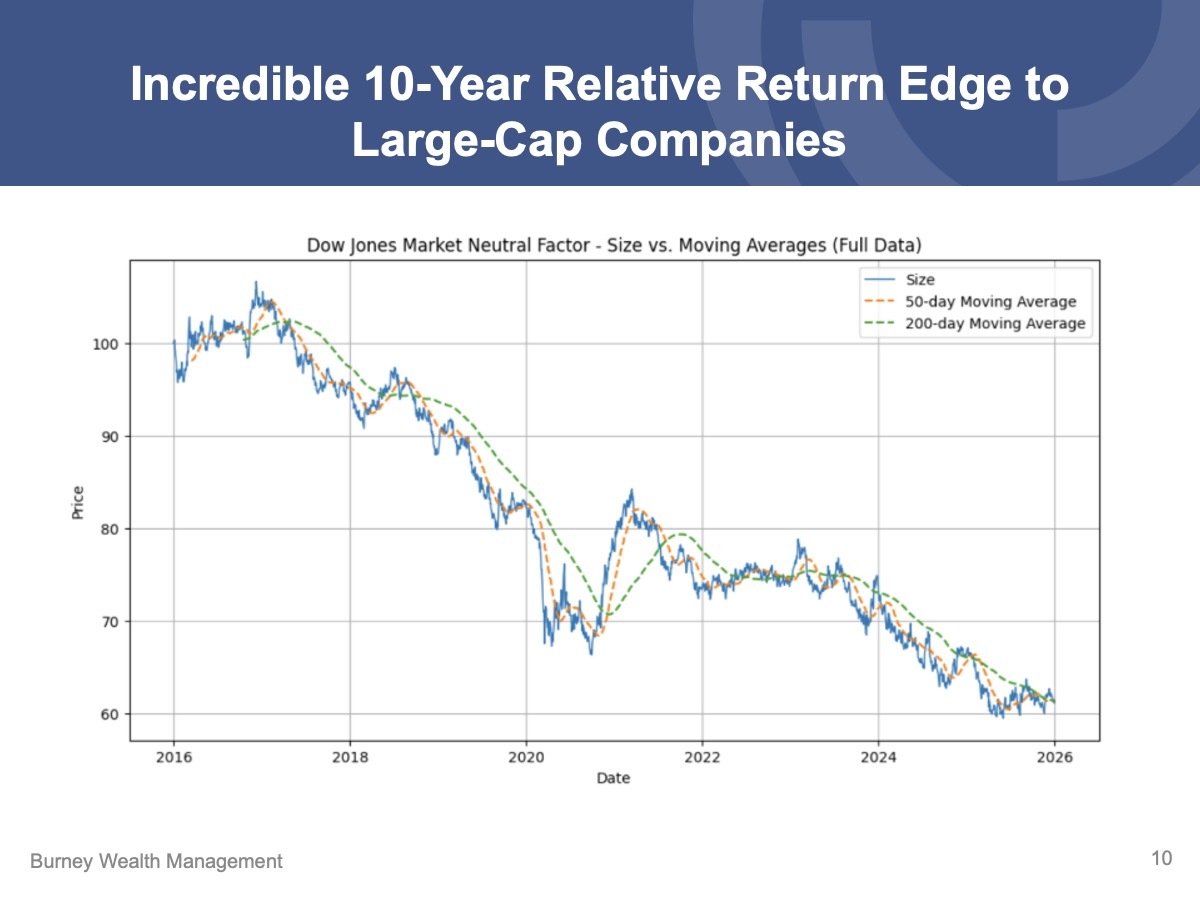

Large-Cap vs. Small-Cap Style and Size Update (20:42)

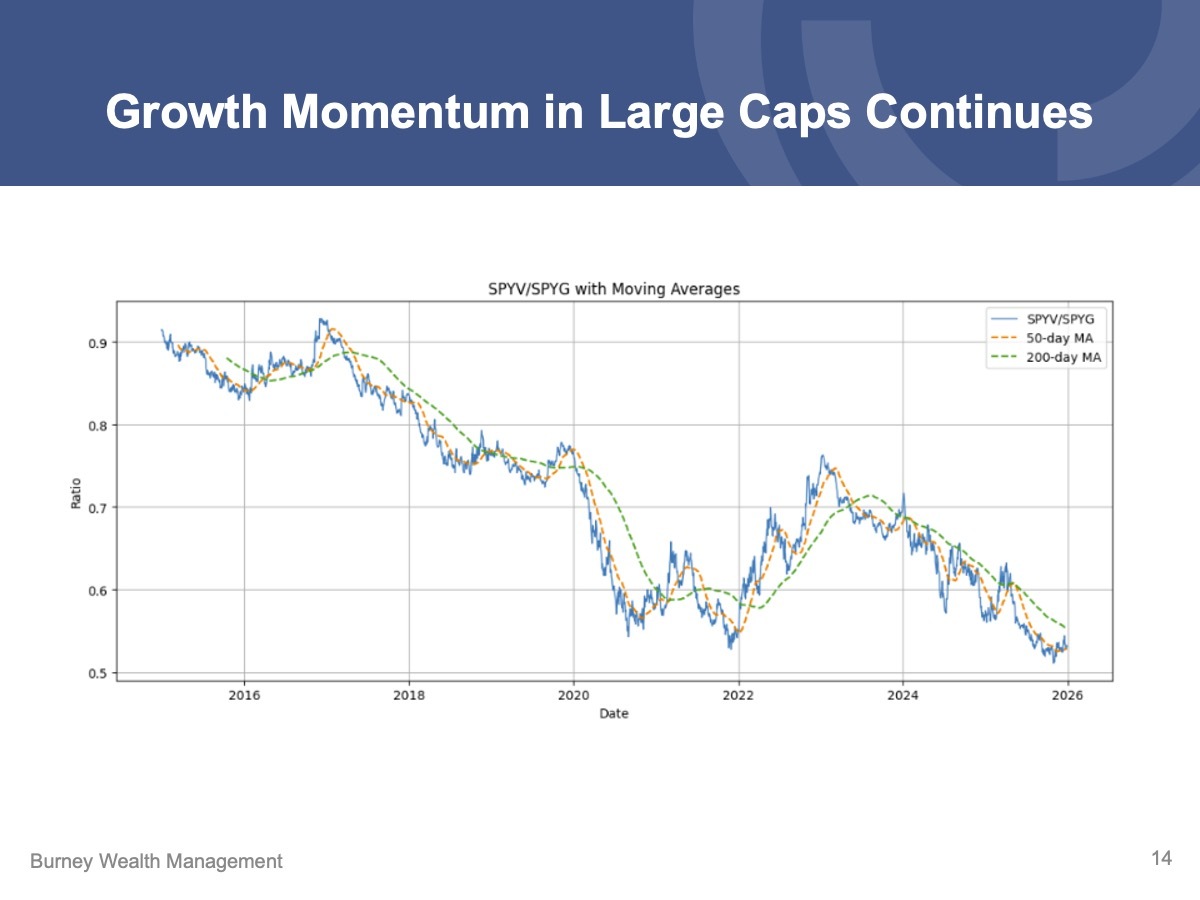

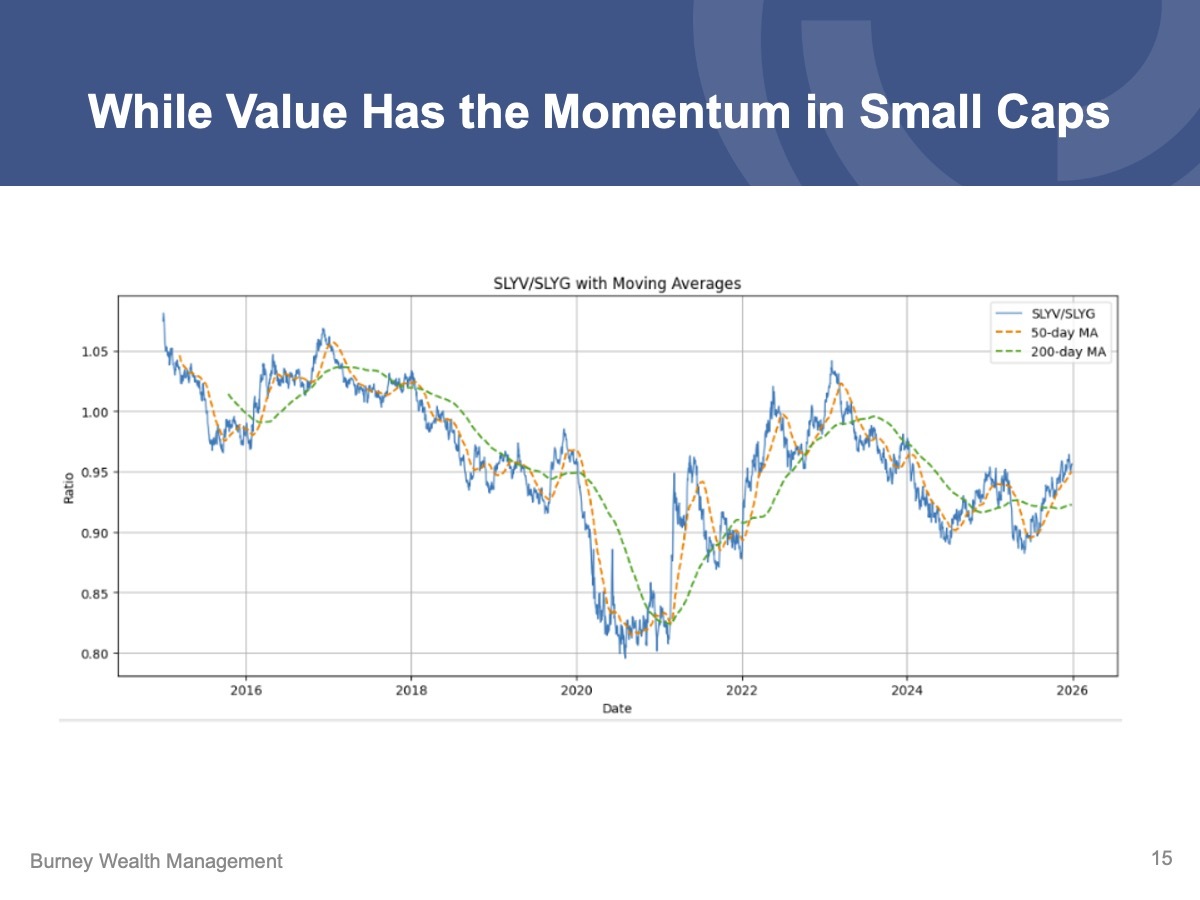

- The large-cap dominance trend that started in late 2016 has continued with only one reversal during the immediate post-COVID period in 2021.

- Large-cap companies only missed analyst earnings expectations by 3%, while mid-cap companies missed by 16% and small-cap companies missed by 25%, justifying the large-cap outperformance.

- Current PE ratios are elevated (S&P 500 at 26 vs historical average of 16), but this is justified by extraordinary profitability, lower interest rates, and strong free cash flow generation.

- The firm is maintaining its bifurcated approach: overweight growth in large caps and overweight value in small/mid caps.

- Six of the Magnificent Seven stocks currently have strong buy ratings, demonstrating they are truly unicorn companies that continue growing despite their enormous size.

Deep Dive Q&A (29:22)

-

Questions addressed in the Q&A session included:

- Can you talk about your international strategies - do you suggest ETFs or managed funds, or do you do it directly?

- Are developed foreign markets a better investment in the short term given policy changes?

- What do you make of volatility in the market?

- What do you see for 2026 with the global turmoil and considerable selloff from yesterday?

- How will Trump's threats towards Greenland impact the market?

- Will economic slowdowns in Russia and Iran impact markets?

- What is the best way to get into international stocks and do you recommend it for 2026?

- Is now a good time to invest in Bitcoin?

- Gold stocks seem to be soaring - any comments on recent growth as central banks tilt towards gold as a conservative hedge?

- How will tax changes from the One Big Beautiful Bill impact both investments and regular people in 2026?

- Could the reason small caps underperformed large caps be the result of tariffs having more impact on small caps?

- If we start to see an AI investment slowdown, how will that impact the markets?

- What is the status of the new ETF launch?

- What do you expect in the first quarter of 2026?

If you have questions like these or wish to discuss your financial planning needs, Schedule a Meeting with us.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.