How Burney Company Selects Stocks

The lifelong passion of Jack Burney, the founder and namesake of Burney Company, was centered around investing in stocks. A West Point engineer by training, Jack was ahead of his time when he started building stock selection models by hand in the 1950’s using little more than financial newspapers and the computing power of a slide rule.

Jack’s key insight was computationally difficult at the time but simple in theory: a stock can be broken down into individual factors – like Growth, Value, Profitability, Momentum and Quality – and these factors can be used to predict which types of stocks will perform well moving forward.

Today, we have the benefit of slightly more computing power than a slide rule and no longer have to do calculations by hand, but the roots of our quantitative stock selection model go all the way back to Jack’s first models when he started the firm in 1974.

Stock Selection Modeling

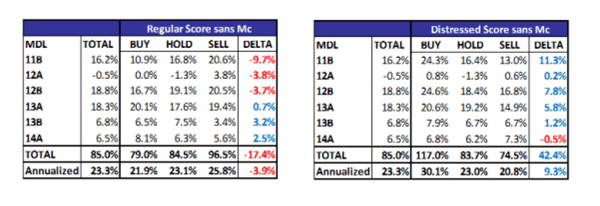

Our modeling process starts with a factor library of over 3,000 factors and is trained on the four most recent normal market environments, controlling for Size and Style market phases. Those 3,000+ factors are whittled down to the top 40 that have a history of working over the long-run and have shown especially strong promise lately. Different models are built for each of the economic sectors as the types of factors important to a tech stock, for example, will be very different from the ones important to a utility.

Once the models are built, they ‘Score’ each company in our investable universe, grouping them into Buy, Hold, and Sell categories. Models are rebuilt twice a year in April and October to make sure they are reflecting up to date information and changing market environments.

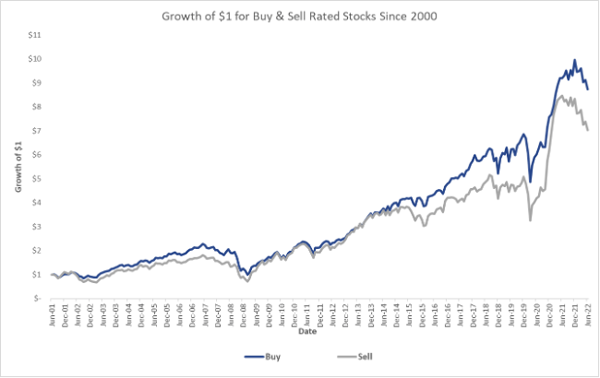

This stock selection model is the backbone of the investing process for Burney Portfolio Managers as they build out portfolios. The effectiveness of the model has a long history dating back to 2000 of creating separation between the stocks it rates as buyable and the ones it recommends avoiding.

Different Models for Different Market Environments

Average returns, of course, don’t tell the whole story as there are times when Score does well and there are times when it does not. One of the enduring aspects to Score is that it typically does well on a relative basis during a selloff as it tends to avoid the most speculative types of stocks. However, in the upswing of the typical V-shaped recovery, it does poorly as the speculative, beaten down stocks bounce back the most.

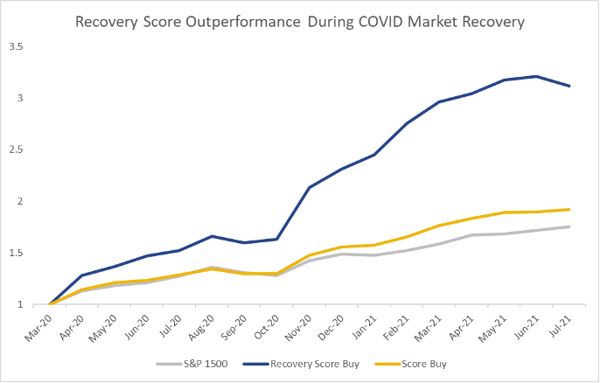

But it turns out market recoveries tend to be remarkably consistent and predictable, creating an opportunity to tweak the model for this different market environment. Modeling on recovery intervals only produces highly effective Score ratings during market recoveries. The types of factors that are important typically change from Value, Profitability, and Quality to Momentum as the stocks that were the most sold recover strongly.

While we don’t always have the opportunity to use our Recovery model – it only can work following a market correction or bear market – it has been the most effective model we build when we do have the chance to use it. Our back tests in 2011 were strong and our first live test in 2015 replicated our findings from the back tests.

Back Tested Results for Recovery Score During 2011 Selloff & Recovery

The most recent opportunity to use Recovery Score was in 2020 following the COVID crash and the results were the best yet.

In practice, we combine Recovery Score with standard Score to ensure stocks in our portfolios remain of high quality. This proves to be a good compromise to take advantage of the opportunity presented by market recoveries while also feeling good about owning a stock long term.

Incorporating Alternative Data

In the late 1990’s, the Burney Analytical Department experimented with advanced statistical techniques like neural networks to try to enhance our stock selection model. The project ultimately failed, in part because of the lack of data and computing power, but also because the scope of the model was too broad. There are simply too many factors that drive stock prices for machine learning algorithms to effectively pick stocks.

That doesn’t mean advanced statistical techniques can’t add value, though.

Twenty years after our failed experiment, we came across a new data set that scrapes the internet to measure a company’s digital footprint to predict if the company will beat on revenue during its next earnings report. Today, there is much more data, much more computing power, and the relationship between higher online engagement and selling more widgets is much more direct than predicting a stock’s share price.

Burney subscribes to this alternative data set as it turns out to be a great complement to our more traditional, quantitative modeling process. While our model is long-term in nature, this revenue beat model is entirely short-term in focus. The rating of the revenue beat model is only relevant for one to three months at a time as companies present earnings quarterly, but it delivers impressive accuracy. During the 4th quarter of 2022 earnings season, 71% of S&P 500 companies beat on revenue compared to 93% of companies this model rated as buyable.

The synergy in models comes from the timing of purchases. While Score aims to find stocks that will do well over the long run, it can fall prey to value traps. After all, markets can stay irrational longer than you can stay solvent. The goal of this new alternative data signal is to better time the entry into positions our standard model identifies as undervalued.

Structure Around Your Investing Process

In what is a testament to Jack’s foresight, Score is a critical component of our active investing approach. While there have been tweaks through the years – like the creation of Recovery Score and the incorporation of this big data revenue beat model – it remains a robust tool as it does not rely on outdated rules of thumb.

While many financial advisors settle for vanilla, cookie cutter portfolios, there is still an opportunity for investors to demand more out of their investments. Before you even become a client, we offer a personal portfolio analysis. Get yours by reaching out today.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.