Why Do I Own This?!?

The whole idea behind asset allocation is to own a bunch of fundamentally different things that behave in fundamentally different ways as part of an investment portfolio. Some years are good for the stock market and some are bad. In the bad years, you want to own things that are going up, or at least not falling, to offset losses in stocks. If the asset allocation is constructed properly, this mix of different assets behaving differently creates a smoother, more predictable ride for a portfolio than that of the individual pieces.

The thing that is hard about asset allocation, though, is sometimes the stock market does really well and the things included in a portfolio specifically to behave differently do not. Why would anyone want anything other than stocks when the stock market is up 30%?

Inevitably, some assets will look great and some will look terrible, leading to the natural question: Why do I own this?!?

Let me start by disclosing our bias. Burney started as an Investment Management firm specializing in building US equity portfolios and, for decades, that’s all we did. Our founder, Jack Burney, famously never owned a bond. If you asked him about it, he would say something to the effect of, “Why ruin a perfectly good equity portfolio with a bond?”

So, we’re strong believers that the stock market is an amazing tool for building wealth and we’re not a big fan of traditional asset allocation advice that we believe puts investors in sub-optimal portfolios. That is why our asset allocation models include a significant allocation to alternatives in addition to stocks and bonds. Ideally, a good alternative investment generates attractive returns but also carries a return stream that is different from stocks and bonds.

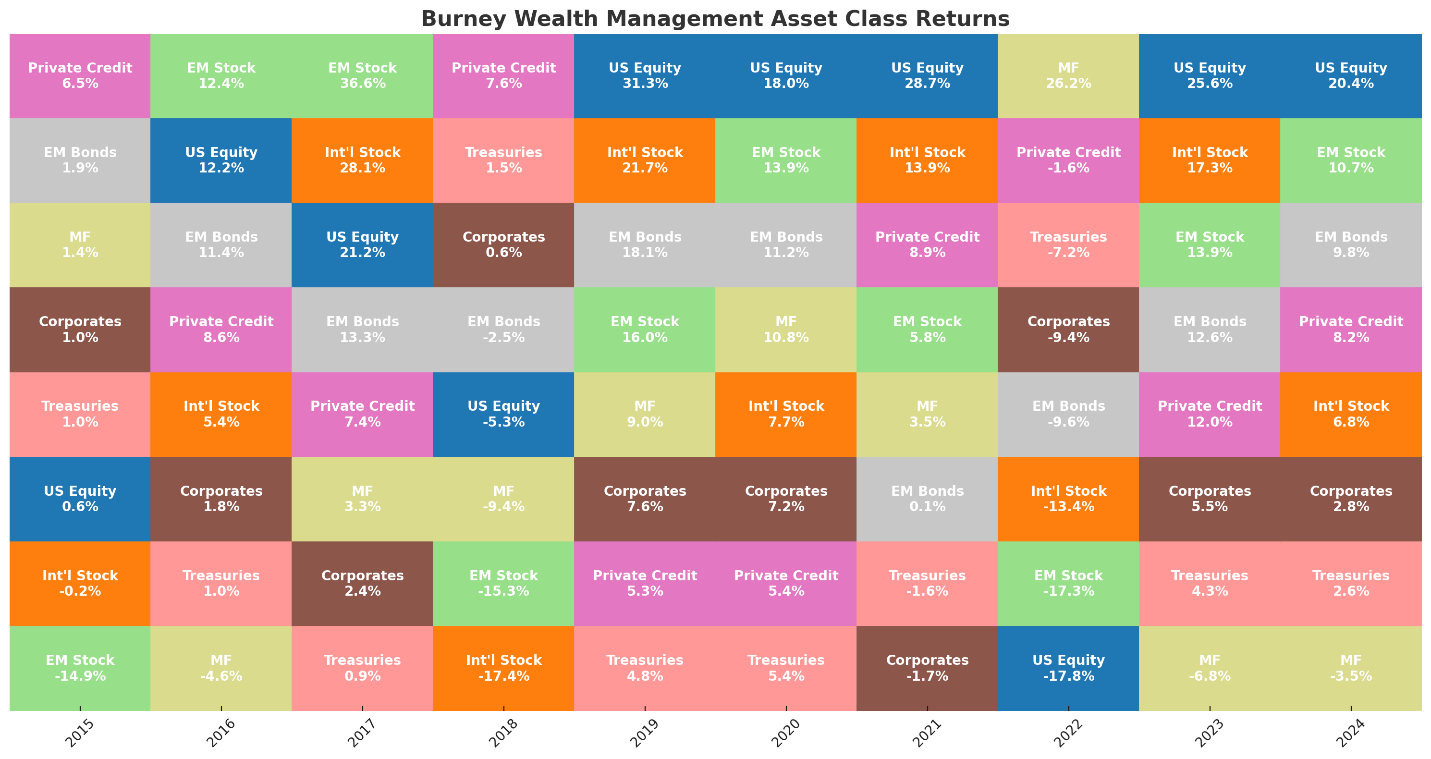

Different is a feature, not a bug, but different can also bring negative attention when the stock market is booming, as it is now. Here is the year-by-year performance of each building block in our asset allocation models over the past 10 years.

Often, the worst performing asset class one year bounces back to be among the best the next year, and vice versa. For example, emerging market equities were the worst performers in 2015 before becoming the best in 2016 & 2017 and back near the bottom again in 2018. US Equities have been on a tear since 2019 but even stocks in the US spent time at the bottom of the chart in 2022 and there is no guarantee they will continue their recent dominance. Goldman Sachs recently forecasted the S&P 500 to return just 3% annually over the next decade. If that forecast comes to fruition, exposure elsewhere will likely matter quite a bit.

Right now, the asset class raising the most questions is managed futures. This is an asset class that relies on trend following in multiple asset classes from stocks to bonds to commodities to currencies to take long or short positions. The broad scope and focus on trends involving a wide array of asset classes allow managed futures strategies to potentially make money in down markets, but also puts them at risk of underperforming in choppy markets. This is the poster child for an asset class that behaves differently, and a year like this one where stocks are up and managed futures are down makes it difficult to stick with them.

Admittedly, this has been perhaps the most controversial holding in our asset allocation models over the years simply because of how differently managed futures operate from other investments. We fielded many questions about why we owned them in the late 2010’s bull market. But managed futures aren’t included in a portfolio to compete with stocks, rather they are there to provide diversification benefits in times of crisis. This paid off during the bear markets of 2020 and 2022, where managed futures outperformed stocks/bonds during the respective downturns.

The 2022 performance was especially noteworthy because it was the Everything Bear Market. Both stocks and bonds saw declines at the same time, but managed futures were the only asset class in our models to achieve gains. And boy did they deliver with a 44% edge over the US stock market. This “crisis alpha” is why managed futures earn a spot in our asset allocation models even though they are likely to underperform stocks during bull markets.

The other asset class being questioned is international equities. Emerging markets and developed markets overseas have lagged US stocks consistently for much of the past 15 years, but we don’t have to go back very far to find an example of when exposure to international stocks really paid off.

The 2000’s are known as the “Lost Decade” because the S&P 500 ended the decade at the same level as it started. This was mostly due to the Dotcom Bubble where outlandish valuations in the tech sector could not be justified by financial results. It was not a lost decade for international stocks, however, as emerging markets were the top-performing asset class for five straight years from 2003 to 2007. Developed markets also outpaced large-cap US stocks during that time. Globally diversified investors did better than investors who only invested in the S&P 500.

While the companies dominating the S&P 500 today are very different from the ones dominating in 1999, there are some similarities. That Goldman forecast referenced earlier cited stock market concentration and valuation concerns as reasons for the tepid S&P 500 expectations. If history ends up rhyming, global diversification could end up looking good over the next 10 years.

The pieces of a well-rounded portfolio should be doing different things. After all, if everything in a portfolio did the same thing at the same time, there would be no diversification benefits. Managed futures propped up portfolios in 2022 when stocks and bonds stumbled. US stocks carried global equity performance in the 2010s and 2020’s just as international stocks did in the 2000’s. A well-crafted asset allocation model should be expected to have some parts going up while other parts go down. It is fair to ask why you own a thing that is underperforming, but periodic underperformance is evidence the asset class is doing its job.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.