How War and Geopolitical Shocks Shape Stock Markets

With a pandemic, inflation, and now war in Ukraine, the 2020’s are forcing investors to refamiliarize themselves with risks that they haven’t had to consider in quite some time. At this point, the pandemic is well internalized and we’re getting there with the inflation story. But a geopolitical shock like Russia’s invasion of Ukraine is new and it is a fair question to ask how past geopolitical events affected stocks.

Of course, the human suffering in Ukraine is very real and we don’t mean to downplay the tragedy on the ground. Our hearts go out to the people of Ukraine who are under attack. But we are receiving questions from clients about the war and how it may impact their portfolios, and there is history to look back on for guidance.

If there is one thing the market does not like, it is uncertainty and the common thread across past geopolitical events is short-term volatility in the immediate aftermath of the event. We certainly have been feeling that as the market’s fear gauge, the VIX, spiked 20% the day of the invasion.

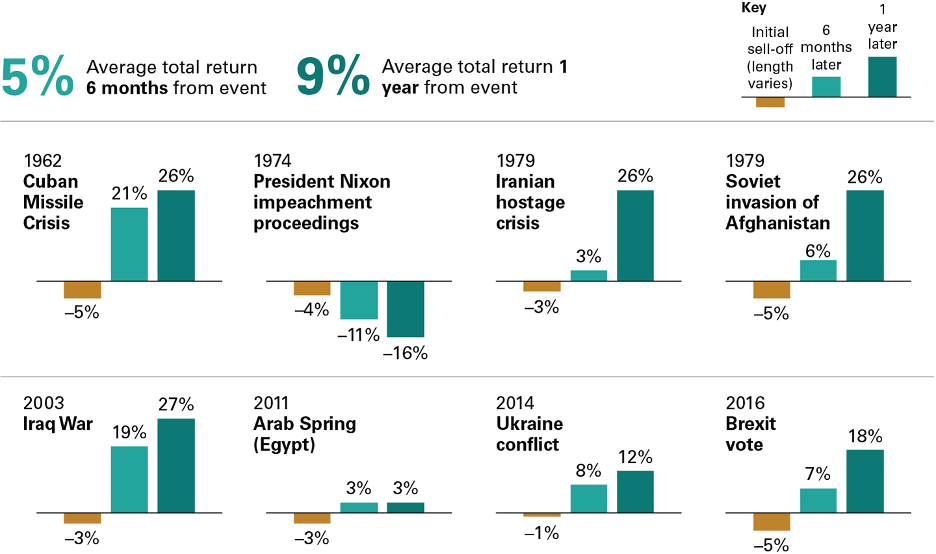

But wars tend to have very little long-term impact on stock market valuations. Per the chart below by Vanguard, the average total return of stocks after a geopolitical shock is 5% six months later and 9% after one year. These numbers are very similar to long-term stock market averages.

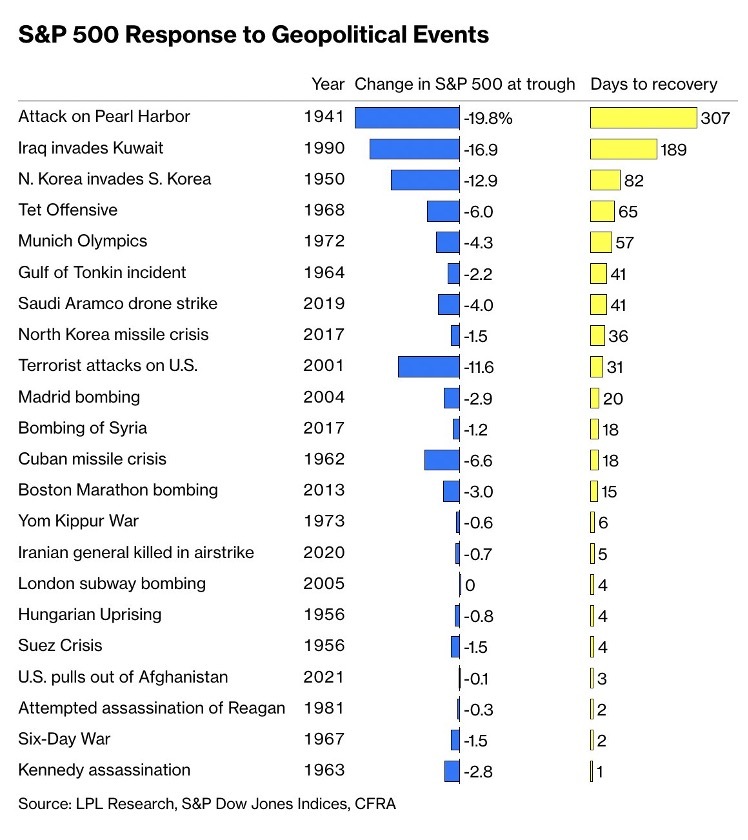

This chart in Bloomberg shows even more geopolitical events going back to World War II and the story is similar. An initial bout of volatility followed by a relatively quick recovery.

We are in the early stages of the conflict in Ukraine and it is unknown what unintended economic consequences will come from the conflict and economic sanctions being placed on Russia. Will there be contagion to financial organizations in Europe? How much will the spike in commodity prices like oil further fuel the recent hot inflation readings? Will the Fed be forced to more aggressively hike rates and how will that affect the US economy?

We don’t know the answers to these questions, but markets are complex and wars usually cannot do enough to shake them from their prior trends and fundamentals. The headlines are scary and there is no shortage of stock market prognosticators willing to give their take on the situation, but we urge our clients to avoid selling based on today’s headlines.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.