Medicare 101 (Part 4): Understanding Part D and Medigap Policies

In the final installment of our Medicare blog series we will discuss the remaining core aspects of Medicare, Part D (drug coverage) and Medigap Policies (supplemental insurance). We will save a discussion on Medicare Advantage plans (an alternative to all of the above) for a future post.

Part D – What Does it Cover?

Part D offers prescription drug coverage to everyone with Medicare. Obtaining drug coverage under Medicare requires enrolling in a private plan approved by Medicare that offers a minimum amount of coverage. These plans will vary in cost and also the types of drugs that are covered.

Part D – What Does it Cost?

Unlike Part A and B, the premium costs for Part D are not standardized and may vary significantly by plan.

Your actual drug plan premium costs will vary depending on:

- The actual drugs that you use

- Whether you go to a pharmacy in your plan’s network

You can go onto the Medicare website and enter the drugs you take and ZIP code to see available plan options and costs.

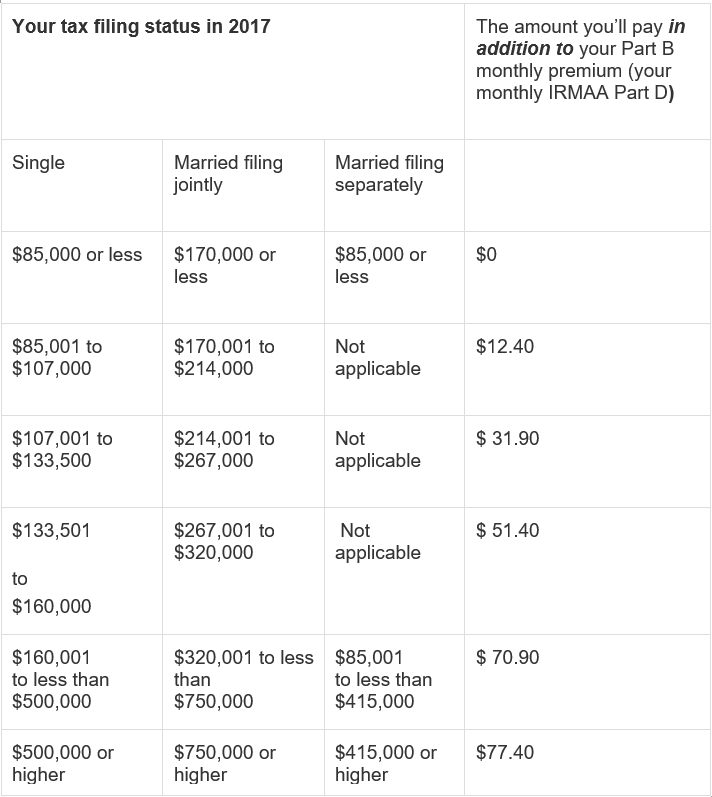

Just like with Medicare Part B, there is a potential additional monthly premium surcharge, known as the income-related monthly adjustment amount (IRMAA), that is applied on top of the base premium you pay. This adjustment is based on the modified adjusted gross income reported on your IRS tax return from 2 years ago:

There is also an annual deductible that must be met before your Part D plan begins to pay its share. Similar to your premium, this amount varies by plan but is limited to $415 in 2019. It is possible that you find a plan that doesn’t have a deductible.

Finally, there is also a potential coinsurance or copayment. These are amounts you pay for each prescription after you’ve met your annual deductible. They can be:

- Copayment: with a copayment, you pay a specified amount (for example, $15) for all drugs that fall within a certain category. For example, you might pay a lower copayment for generic drugs than brand-name drugs.

- Coinsurance: with coinsurance, you pay a percentage of the cost (like, 20%) of the drug up to a certain amount.

All of these characteristics, from premium costs, deductibles, and copayments/coinsurance are unique to the plan you elect to enroll in. This is a crucial aspect of health care planning for retirement and often requires the help of a professional to navigate the decisions. We cannot emphasize the importance of “shopping around” enough.

Understanding Medigap Insurance

A benefit of the Medicare system is that it is specific in what it does and does not cover. This allows for a level of certainty but also the burden for other costs that might be variable and significant. Medigap policies allow individuals to close some of the uncertainty gap as it relates to Medicare coverage and transfer the risk to the insurance company. these plans are sold by private companies to aid in covering costs that the other parts of Medicare does not cover such as copayments, coinsurance, and deductibles.

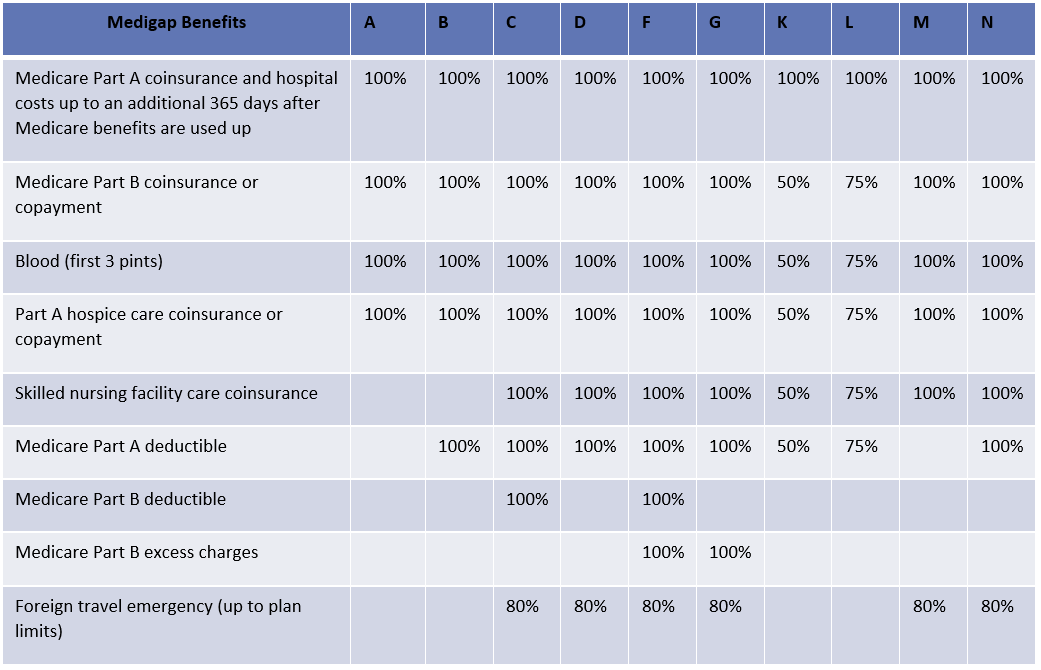

There are 10 different Medicare supplemental plans available for purchase, leaving retirees with a significant decision to make. A benefit to consumers is that private companies are forced to standardize these plans to create a level playing field. This way seniors only need to focus on the 10 available plans and which is best for them. The Medicare website provides a great overview of these plans and the different coverages and characteristics.

Here are some additional tips when shopping for a Medigap policy:

- Chose the policy that offers the coverage you need

- Chose a reputable company offering that policy at the lowest price

- Make sure your health care provider processes the billing for the company you chose.

As with Part D, you can use the Medicare website to estimate costs for Medigap policies in your area.

To learn more about Medicare and the specifics, the government has a great resource that it publishes annually, titled Medicare & You, that reviews the Medicare system and coverages in greater detail.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.