What You Need to Know about Taxes in Retirement

Retirement is one of life’s most anticipated and exciting transitions. We dream of travel, time with the family, and having the freedom to do whatever is most important to us. Planning for this big transition is a delicate balance of organizing our financial lives while crafting our desired calendar.

One of the most underappreciated aspects of the retirement planning process is taxes and more importantly, how our tax picture might change when our paycheck goes away.

Retirement vs. The Working Years

During our working years our tax situation has a level of predictability. While our income and deductions might rise and fall over time, there isn’t much maneuvering we’re able to do as our taxable income is subject to the standard IRS income tax rates. We can try and maximize our itemized deductions, manage our taxable investment income, and get creative with our tax advisor but overall, our tax picture has limited wiggle room.

Once retirement approaches, our tax planning opportunities can change significantly. A group of 4 different taxpayers needing to generate $100,000 of income from their investment portfolios in retirement could be hit with 4 drastically different tax bills. This dynamic presents both challenges and opportunities for retirees, and some of us may have more flexibility than others when it comes to tax planning.

Tax Treatment of the Typical Retirement Income Building Blocks

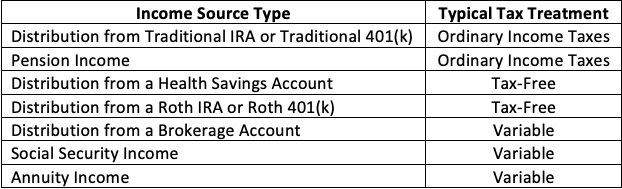

Retirees typically generate their retirement “paycheck” through some combination of withdrawing funds from various types of investment accounts, claiming their Social Security benefits, and maybe receiving a pension or annuity income.

Here is a quick reminder of the tax treatment of the most common types of retirement income:

For more information on the tax treatment of various types of investment accounts, visit our previous blog post.

It’s important to emphasize there is a significant amount of variability and complexity related to each income source. Someone living completely off of a Roth 401(K) and Social Security income will have a much different tax experience compared to someone living off of a Traditional IRA, Pension Income, and Social Security. This highlights the importance of thoughtful decision making when developing an income plan in retirement.

What Are Key Factors That Determine YOUR Retirement Tax Bill?

A lot of what your tax bill looks like throughout retirement can be boiled down to the following factors:

- The makeup of your investment accounts: What percentage of your overall portfolio is invested in each of the following buckets: Traditional IRA or 401(k), Roth IRA or 401(k), and taxable brokerage accounts? Retirees with only one of these account types will be more limited in maneuvering their tax situation than someone with a relatively equal distribution across all three. There are also very different long-term consequences of the various investment buckets, especially how they’re treated when you die. TIP: Create a family balance sheet and take time to understand your unique account type distribution.

- Where you decide to withdrawal funds from (and when): With certain limitations (specifically, the start of Required Minimum Distributions from Traditional IRA’s and 401(k)’s at age 72) retirees have an element of control around which account type they pull funds from to pay for their living expenses. The decision you make around where to pull income from (and in what amounts) can materially impact your tax bill. TIP: Be careful when following the various rules of thumb stating which account type you should pull from first – there is no one-size-fits-all approach.

- When you decide to claim Social Security Benefits: Social Security benefits receive their own special tax treatment. When you decide to claim your benefits can substantially impact the timing and amount needed to be pulled from various other sources, which in turn impacts the taxes you pay. TIP: to learn more about our Tax Planning Process, check out this demo

- Where You Pay Your Taxes From: During our working years we’re usually paid a salary from our employer and taxes are withheld from each paycheck. Many of us don’t need to worry about making estimate tax payments to the IRS directly because these paycheck withholdings are likely sufficient until we file our taxes. In retirement, some income sources allow for withholding while others do not. Further, withholding taxes from certain income sources to meet your spending needs might also increase the taxes you pay without you realizing it! Careful planning should be applied when it comes to deciding where to withhold/pay taxes from and whether or not to make estimated payments.

How To Proactively Plan for Taxes in Retirement

With a better understanding and key considerations behind us, here are some tips to help you plan ahead and navigate the complexities of taxes in retirement.

- Position yourself for flexibility: A first step in tackling taxes in retirement is planning in the decades/years leading up to retirement to make sure you have flexibility with regards to the income sources and account types you’ll have available when you stop working.

- Carefully review your tax return each year: Retirement tax planning is a mix of art and science as well as an ongoing learning experience. Make time to carefully review your tax return each year to better understand your tax situation and how it’s changing over time. Here is an example of how we like to help clients review their tax returns

- Balance The Long-Term and Short-Term: For many of us, the retirement years will last just as long as our working years. This means a decision that might make sense for year 1 of retirement might not make sense at all in year 15. When making decisions around taxes, think about the long-term implications and not just what the impact in a specific tax year will be.

- Work with a qualified advisor: While retirement is a life event most of us will experience, no two retirements are the same. This becomes dangerous when generic and rule-of-thumb advice is given for retirees as a way to help them simplify the retirement process. Don’t be afraid to ask for help and lean on a qualified tax and financial advisor.

For more information, check out our “On-Demand” webinar What Internet Searches (And Your Friends) Aren’t Telling You About Taxes in Retirement.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.