How Should My Investment Approach Change When I Retire?

A very common question those approaching retirement ask is “what changes should I make to my investment portfolio, and when”?

Understanding the Financial Transition into Retirement

After decades of saving and accumulating assets, it is now time to start thinking about spending down your assets. The portfolio that once saw its balance rising through consistent deposits and generous long-term market returns must now become an income source for your retirement “paycheck” (the money you’ll need to live off of now that you’re no longer employed).

This transition from accumulating to spending down your assets is one of the most critical financial transitions you’ll ever need to make. You’ll also have little margin for error, as investment mistakes in retirement often lead to running out of money or needing to go back to work later in life.

While there are numerous considerations related to this transition, this blog post will focus specifically on understanding your portfolio withdrawal rate and how that translates to the amount of risk you should take in your portfolio.

Key Question #1 : What Will My Portfolio Withdrawal Rate Be?

The first step in determining what changes should be made to your retirement portfolio is understanding the required withdrawal rate needed from your investments. Your portfolio withdrawal rate is the percentage each year you need to take out of your investment accounts to supplement your living expenses.

Example: John and Mary have accumulated $1,000,000 in investment assets and they plan to retire next month. Their retirement spending budget is $100,000/year after taxes and their Social Security and Pensions will provide annual after-tax income of $60,000. This means they’ll need to take $40,000/year out of their portfolio (the difference between their annual spending need and their fixed income sources). This gives them an initial annual portfolio withdrawal rate of 4% ($40,000 divided by the $1,000,000 portfolio balance).

While this example is simple in nature, it is critical to understand how your withdrawal rate might change over time. For example, you may need to take more out of your portfolio early on while you wait to collect Social Security or a pension. You may also need to take more money out of your portfolio if inflation is higher than expected or an unexpected life or health event occurs. Proper financial planning will help you account for these unexpected events so that you’re not caught off guard.

TIP: A general rule of thumb (backed by research) is that your average portfolio withdrawal rate in retirement should generally not exceed 4%

Key Question #2: How Will Stock Market Returns Impact My Retirement Plans?

Once you have a handle on what your required withdrawal rate will be, the next step is understanding how the exact sequence of stock market returns around your retirement date (either good or bad) will impact your spending ability and portfolio balance over time. This is often a brand-new risk for retirees to consider since the timing of market returns doesn’t necessarily matter as much when you’re consistently saving money over many decades while leaving your portfolio untouched.

For this reason, we have a tendency to focus on average investment returns over long periods of time and then use those average returns to forecast our retirement portfolio trajectory. However, rather than average returns, the specific order (sequence) of market returns is one of the more significant drivers of retirement planning success or failure.

A lot of people understand in theory that they may need to take less risk with their investments when they transition into retirement, but few understand why.

To further explain this concept, we will provide several examples using market return data from 1999-2021.

We chose this specific time frame for the following reasons:

- It represents the most recent 21 years of market returns

- It captures the dot com bubble bursting, the Great Recession, and the COVID-19 Selloff and recovery, all of which help show how big market and economic events can impact our retirement plans.

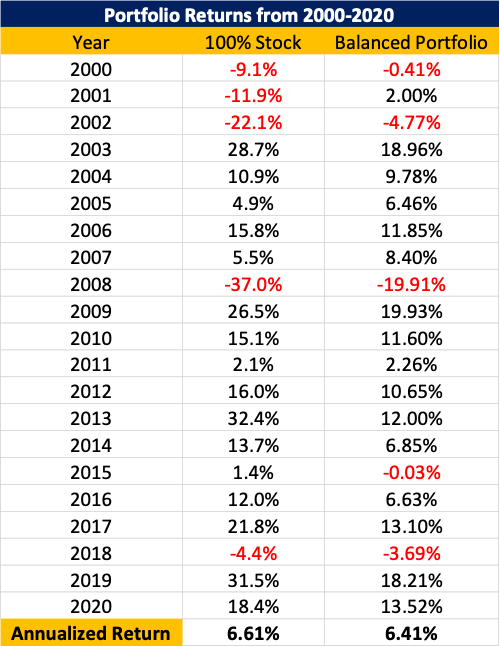

For these examples we will be comparing a retiree who chose an all-stock portfolio (invested in the S&P 500) for the prospect of higher returns, to an investor with a diversified portfolio with lower return expectations but less volatility and risk. We will then use the two possible portfolios to run three scenarios that help illustrate the importance of timing when it comes to retirement portfolio withdrawals. Here are the year-by-year returns of the all-stock portfolio versus the balanced, lower risk portfolio:

Portfolio Returns from 2000-2020

Portfolio Returns from 2000-2020Performance data shown represents past performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Average annual total returns include reinvestment of dividends and capital gains.100% Stock portfolio is the S&P 500 Total Return Index. The “Balanced Portfolio is 50% Bloomberg Barclays U.S. Aggregate Bond Index, 35% Russell 3000 Index,10% MSCI EAFE Index, and 5% Dimensional Emerging Markets Index.

A Few Initial Observations and Historical Context

- While we are big believers in the long-term benefits of investing in stocks over other asset classes, we also understand the short-term risks they can pose for retirees spending down their portfolios

- While the S&P 500 has averaged just over 10% per year over its almost 100-year history, there are meaningful windows of time where its annualized return is much lower, and this 20+ year period is one of them. Don’t be fooled by multi-decade long-term average returns when it comes to retirement decision making because:

- The ride isn’t always as smooth as it appears: Annual returns for the S&P 500 came within two percentage points of its long-term average of 10% in just six of the past 95 years. This means most years the returns are meaningfully higher or lower than the average.

- The possible return outcomes are WIDE: Yearly returns have ranged as high as up 54% and as low as down 43%

TIP: A key decision a retiree needs to make is do they gamble on the short-term direction of stock market returns and risk a negative retirement scenario (even if unlikely), or do they focus on diversification to mitigate even the slightest chance that a bad market environment can derail their retirement plans?

Moving on, let’s look at how this data translates to our retirement portfolio decision making. We will focus on three types of potential retirement investors; one that doesn’t need to spend down their portfolio, one that is able to save through retirement, and one that will need to live off of their retirement savings.

FACT: a majority of individuals will need to tap into their retirement savings for supplemental income

.jpg)

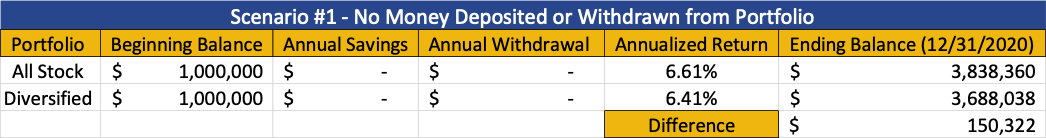

What If I Don’t Deposit or Withdraw Any Money from My Retirement Portfolio?

In our first scenario, we look at the impact of the “static portfolio”, meaning money is initially invested and then no money moves into or out of the portfolio over the entire period. In that case, let’s see how things compare at the end between the two investors:

In this instance the outcome is what we would expect, the portfolio with the higher average annualized return yielded a larger portfolio balance at the end of the period when compared to the lower growth portfolio.

Observation #1: If you do not need to withdraw money from your portfolio in retirement, you have the capacity to take more risk and capture the long-term benefits of investing in stocks regardless of their short-term fluctuations.

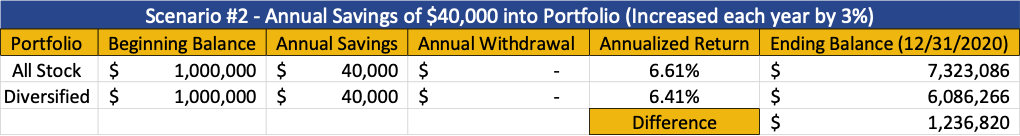

What If I’m able to Save Money Each Year into My Retirement Portfolio?

In our second (but very rare) scenario, we look at someone who is able to add money consistently into their portfolio throughout retirement:

*annual deposits are increased each year by 3% to account for inflation

Again, in this instance the higher growth portfolio comes out ahead. The all-stock portfolio is especially aided in the early years as the investor is adding money to the portfolio even as the markets exhibit consecutive negative annual returns from 2000-2002. This is why many champion the benefit of dollar-cost averaging, which allows investors the opportunity to buy in to the market at various price points over time.

Observation #2: If you are in the rare camp of being able to save while in retirement (either because your other income sources exceed your spending needs, or you have a financial windfall such as the sale of business) you again have higher capacity to take risk and can dollar cost average into a stock heavy portfolio over time to capture their higher long-term return potential.

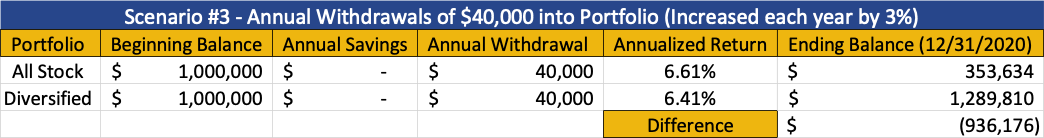

What If I Need to Live Off of My Portfolio?

In our final (and most common) scenario, we look at the impact of taking money out of both portfolios to supplement our living expenses as market volatility unfolds. While in both scenarios above the all-stock portfolio came out the “winner” as it was able to ride out the ups-and-downs of the market, the presence of portfolio withdrawals creates a much different outcome:

*annual withdrawals are inflated by 3% each year to account for inflation

The presence of bad stock market returns early in retirement created a nightmare scenario for the retiree living off of their portfolio. Being forced to take living expenses out of a portfolio that has fallen sharply in value means those withdrawn dollars don’t have time to recover as the stock market recovers because they’ve already been spent. Timing is absolutely critical for a retired investor!

Observation #3: If you plan to withdraw money from your portfolio early in retirement, you will want to be extra mindful of the timing of market returns. You'll have smaller room for error and may want to reduce risk to avoid premature depletion of your portfolio.

We will leave you with some important takeaways:

- Invest based on your specific circumstances – your withdrawal rate and the specific income need from the portfolio should determine how much risk you take

- If you need to take money out of your portfolio early in retirement, focus on balance over the prospect for higher returns. It is not worth the risk that a bad string of stock market years could lead to a premature depletion of your portfolio.

- If you don’t need to take money out of your portfolio early in retirement, speak with your advisor about the right amount of risk to take. There are lots of rules of thumb around conservative retirement investments, but you might be shortchanging yourself long-term if you are more conservative than you need to be. Context is everything.

Have more questions?

Click here to download our Retirement Readiness Checklist and schedule a time to speak with one of our credentialed advisors.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.