Taking Control in Volatile Markets

Without question, we are in the midst of a historical time for financial markets. We’ve just witnessed the fastest bear market in history and some of the worst single-day declines since the stock market crash of ’87. If there was ever a time to test our appetite for market ups and downs, it has arrived. We will look back on this as a risk tolerance boot-camp.

As COVID-19 makes it way around the world, individuals and businesses are working hard to protect themselves and also plan for an uncertain future. Markets like certainty and economic growth, and right now they’re getting a significant amount of uncertainty, a potential recession, and a worldwide health crisis. We’ve talked at length about the current climate during our most recent webinar.

While we don’t know when things will settle down, we do know that markets will eventually do what they always have – recover and grind higher while rewarding the patience and discipline of those that stayed invested. Markets hit new highs but never hit new lows. However, keeping cool and sticking with your investments can be much easier said than done. We’ve found that there are two main drivers of our ability to stay strong and confident during turbulent times:

- Do you have a financial plan? Financial planning is the act of aligning your life goals with your portfolio. It is making sure you’re taking the appropriate amount of risk based on your unique circumstances and then controlling what you can control, all with the help of your financial advisor. Things like managing your tax situation, making sure you’re saving in the right places and having a plan for big life events such as retirement and unexpected healthcare costs begin to take priority over watching the daily swings in the market. These are just some examples, but having a plan provides peace of mind and confidence in your future. The stock market can’t always provide that, but a financial plan can.

- What is your level of fear? We’re all wired to respond to volatile markets differently. Some of us (even financial professionals) get very nervous when markets decline significantly, while others don’t flinch or even see every market drop as an opportunity to put cash to work. There is no right or wrong answer, we just need to acknowledge where we land on this spectrum and modify behavior and decisions accordingly.

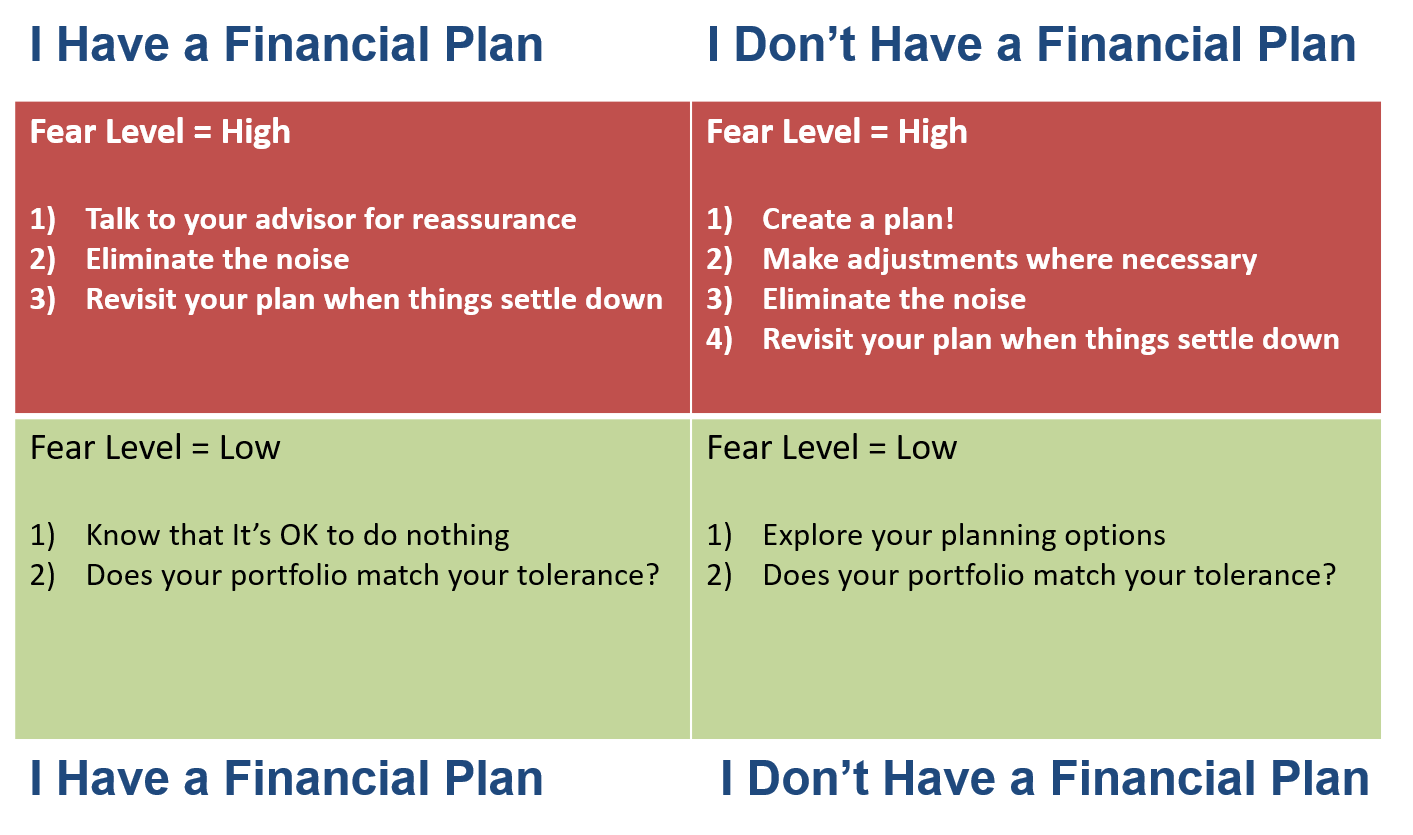

With that, I’d like to introduce a framework for managing through these tough times based on your prior planning efforts and current state of fear. This is broken down to 4 scenarios along with some actionable steps at each level (please note that some of these steps might have redundant text across scenarios):

Scenario 1: I have a financial plan, but my fear level is high

So you’ve put a financial plan in place but are still anxious about the market environment? No problem, a plan is there to reinforce us when markets are unsettling.

We recommend considering the following actions:

- Reach out to your advisor for reassurance. Now is the perfect time to review your plan and regain confidence in your financial future. A good plan accounts for these types of market environments, makes reasonable investment return assumptions, and places an emphasis on optimizing other areas of your financial life to add an additional boost to your chances of success.

- Eliminate the noise where possible. Speaking with your advisor will allow you to focus on your specific situation, which is what’s really important. While we all want to be informed and know what is happening around us it is critical to understand that the financial media knows nothing about you and your goals. They are informing the public and also trying to make money selling ad space.

- When markets do settle down and begin to stabilize, revisit your plan again. Planning is not a one-and-done exercise. In fact, you should review it at least annually with your advisor to reinforce the right decisions and keep you confident. Doing this in both good and bad markets creates an added layer of security and encourages the best kinds of behavior.

Scenario 2: I don’t have a financial plan, and my fear level is high

Of all four boxes in our matrix, this is the most unsettling place to be. The angst of the market combined with an uncertain future outlook are where we get sleepless nights and are prone to making knee-jerk decisions with our money.

Use the following steps to get back on track:

- Do not wait, create a financial plan. We have a whole team here dedicated to helping you and there is no wrong time to start planning. It gives you the opportunity to take a step back and prioritize what is really important and also take a look “under the hood” to see if you're currently on track to meet your goals. There might be a combination of good and bad news delivered as part of this exercise but it at least removes the mystery.

- Once the initial planning conversation is out of the way it is time to work with your advisor to implement some changes. You might make some portfolio adjustments, change your savings rate, or implement a number of other strategies you were never aware of before. Taking action in times of market turbulence helps put you back in the driver’s seat and in control.

- Eliminate the noise where possible. Having a plan now allows you to focus on your specific situation, which is what’s really important. While we all want to be informed and know what is happening around us it is critical to understand that the financial media knows nothing about you and your needs. They are informing the public and also trying to sell lots of ad space.

- When markets do settle down and begin to stabilize, revisit your plan again. Planning is not a one-and-done exercise. In fact, you should review it at least annually to reinforce the right decisions and keep you confident. Doing this in both good and bad markets creates an added layer of security.

Scenario 3: I have a financial plan, and my fear level is low

Just like the last scenario was the most uncomfortable of the four, this is generally the most appealing place to be. Having a plan provides peace of mind and on top of that not being emotionally swayed by the markets becomes the icing on the cake.

At this stage it is important to consider the following:

- Know that taking no action is a completely reasonable response. You’re confident in your financial future and aren’t overly invested in the market panic. Sit back and enjoy life.

- If you’re going to do something, go ahead and make sure your portfolio matches your risk tolerance. Your risk tolerance should be revisited every several years and many times we run into clients that actually have a higher capacity for risk than they thought. This means they’re invested more conservatively than they probably should be. Being too conservative could mean lower returns over time in the context of your risk tolerance. This is a great conversation to have with your advisor.

Scenario 4: I don’t have a financial plan, and my fear level is low

I think this is the most interesting of the four scenarios. As an investor you aren’t rattled by the market swings and you also haven’t been motivated to put a plan in place, so your options become varied:

- Unlike the last scenario where we advised it was OK to do nothing, I would still encourage you to at least consider your planning options. Maybe your portfolio is on track and doesn’t need any tweaking but planning is a lot more than just investments. Are there strategies you aren’t taking advantage of that you should be? It never hurts to explore that question and sometimes the solution leads to many dollars added back into your net worth. Worst case scenario you end up confirming you are doing all the right things.

- This is also a good time to go ahead and make sure your portfolio matches your risk tolerance. Your risk tolerance should be revisited every several years and many times we run into clients that actually have a higher capacity for risk than they thought. This means they’re invested more conservatively than they should be. Being too conservative could potentially mean lower returns over time. This is a great time to review this with your advisor just to make sure.

Taking advantage of your financial future is all about controlling what you can and letting the markets run their course in the short-term. The current landscape creates an incredibly attractive opportunity to do this, both from an opportunistic standpoint and as a distraction from the volatility. You will continue to hear varying opinions and predictions from market “gurus” (from best to worst case scenario) but the reality is no one knows what the next few months will look like. Hopefully, this blog post provides some ideas and action items to get you through on the other side in an even better place.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.