Get to Know Social Security Retirement Benefits: A Complete Guide

In the realm of retirement planning, there is a lot of information out there that can cause uncertainty or confusion in the years leading up to that big day of retirement. Regardless of what you know or what you have read, we believe you deserve to walk into that last day of work with confidence for your future. Our recent blog, How Should My Investment Approach Change When I Retire? gives you an idea of how different aspects of your portfolio will help supplement your income in retirement.

Another aspect of retirement and supplementing your income is Social Security and understanding the nuances that come along with it.

If you are thinking about Social Security, that probably means it’s about to affect you in some capacity, whether it’s for you, your spouse, a parent, another family member, or even a friend. The best place to start would be to set up a MyAccount login through the Social Security Website. You will be able to find your most up-to-date earnings record as well as look at future estimated benefit amounts for a range of ages at which you can claim your benefit.

Wealth Advisors Brenna Surette and Ben Scrivener discuss the process of claiming Social Security benefits as part of our Byte Size Retirement series.

We recently sent out a survey to our clients asking what you wanted to know regarding Social Security, and we got a lot of great feedback. We discovered that the most common unknowns for clients could be solved by answering the following questions:

- What is Social Security?

- How is my retirement benefit calculated?

- How is my retirement benefit taxed?

- What is a spousal benefit?

- What happens to my retirement benefit when I die?

- Can I work part-time and claim my retirement benefit at age 62?

- When should I claim my retirement benefit?

In this blog, we aim to share the answers to the above questions to provide you with a better understanding of not only how Social Security income works but how it fits into your specific long-term retirement plan.

Let’s dig in.

1. What is Social Security Income?

Let’s go through a brief history of Social Security to get us up to speed. In 1935 and in the wake of the Great Depression, President Franklin D. Roosevelt wanted to keep the United States from falling into a recurring economic depression, so he signed the Social Security Act as he attempted to bring economic stability to retirees in the form of an entitled social insurance benefit program. From there, the Social Security Administration (SSA) was born, which later revised its agenda to add many new aspects to the benefits program, including Disability in 1956 and Medicare in 1965. The full spectrum of benefits as we know it today is referred to as Old Age, Survivors, and Disability Insurance or OASDI.

The idea behind Social Security is pretty straight forward:

When you are working, you pay into the Social Security system via a payroll deduction called the “Federal Insurance Contribution Act” or FICA. When you retire and reach the appropriate age, you are paid a benefit for the rest of your life. When you claim your benefit, current workers’ pay into the system to fund your benefit, and so on, providing stable income to retirees.

How is FICA calculated?

The deduction is based on what is called the Social Security wage base. For every dollar you earn up to wage base, 6.2% of it is deducted for Social Security. Furthermore, your employer pays another 6.2% on the same amount for a total of 12.4% of your salary that is paid into the Social Security retirement system. In 2023 the Social Security wage base is $160,200.

For every dollar you earn up to wage base, 6.2% of it is deducted for Social Security. Furthermore, your employer pays another 6.2% on the same amount for a total of 12.4% of your salary that is paid into the Social Security retirement system.

Example:

Sarah Middleton will earn $250,000 this year from her job as a mask saleswoman. The first $160,200 of her salary will be taxed at 6.2% or $9,932.40 paid by Sarah, plus another $9,932.40 paid by her employer for a total of $19,864.80 paid to the Social Security system.

Before you can receive your retirement benefit, you must become eligible to receive it first by becoming fully “insured.” After all, social security is an insurance program, and you become fully insured once you reach 40 quarters of coverage or credit. This means that you have 40 quarters, or ten years of earnings, and paid into the Social Security system during those years by paying FICA.

Now that we understand what Social Security is and how the system is funded, and eligibility rules, let’s see how benefits are calculated.

2. How is my retirement benefit calculated?

Benefits are calculated by first finding the amount you are eligible to receive upon reaching your Full Retirement Age or “FRA.”

- Born before 1960: FRA is 66

- Born after 1960: FRA is 67

This amount is known as your Primary Insurance Amount or “PIA,” and once you have this, you can adjust it for the age at which you will begin taking your benefit. You can claim as early as age 62, with a reduced benefit or as late as age 70 with an increased benefit, and all in between.

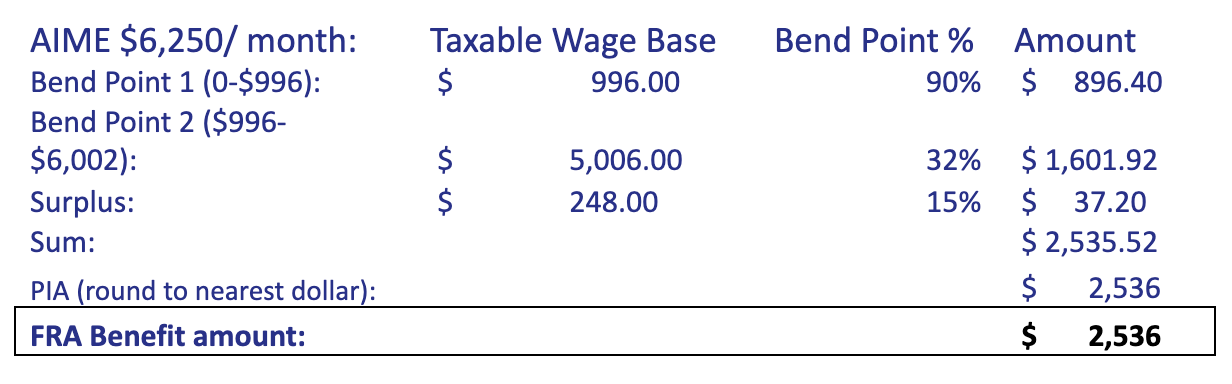

Your PIA is calculated by taking your highest earnings over a 35-year period, known as the Average Indexed Monthly Earnings, or AIME, adjusting for inflation and applying it to the following Social Security bend points formula for 2021:

- 90% of the first $996 of your AIME

- 32% of any amount over $996 up to $6,002

- 15% of any amount over $6,002

- The sum of these equals your PIA.

Let’s take a look at an example assuming the AIME calculation comes to $6,250/ month, the AIME of someone who averaged $75,000 per year for 35 years with inflation.

As you can see, the calculation weighting favors lower earners as they are more likely to rely on Social Security benefits more than higher earners.

What if I claim my retirement benefit outside of FRA age?

The calculation above is based on FRA, but as mentioned earlier, you can claim between ages 62-70. In the case of claiming your benefit early, as in prior to FRA, your FRA benefit can be reduced up to 30%.

i) Early Retirement:

Benefits are reduced 5/9 of one percent before FRA, up to 36 months. If you claim more than 36 months before FRA, then the benefit will be further reduced 5/12 of one percent per month to a maximum of 60 reduction months. For example, if you reach the maximum of reduction months, you will be claiming at age 62, 60 months prior to FRA at 67.

ii) Delayed Retirement

As you are penalized for claiming early, you are pretty well compensated for delaying your benefit claim past FRA. Anybody born after January 1, 1943, receives 8% credit for each year they delay claiming their benefit. So, if your age 67 FRA benefit is $2,586, but you delay until age 70 to claim, your monthly benefit would be $3,206/ month.

Quick note:

- If you only have 30 years of earnings instead of the full 35 years, $0 will be used to calculate each of the remaining five years—this will bring down your average.

- Suppose you average $160,200 of earnings per year (Social Security Wage Base). In that case, you are eligible for the highest Social Security benefit amount, which is currently $3,627, if you reached FRA and began claiming in 2021.

- You do not have to do these calculations on your own, the SSA will do them for you and provide you with a PIA amount for FRA and benefit estimates if you were to claim early or delay until 70, but these are the calculations that happen behind the scenes.

Ok, we know how much you will earn in Social Security benefits, but how will those benefits be taxed, you ask? You’ve read my mind.

3. How will my retirement benefit be taxed?

Wealth Advisors Brenna Surette and Ben Scrivener discuss Social Security Taxability as part of our Byte Size Retirement series.

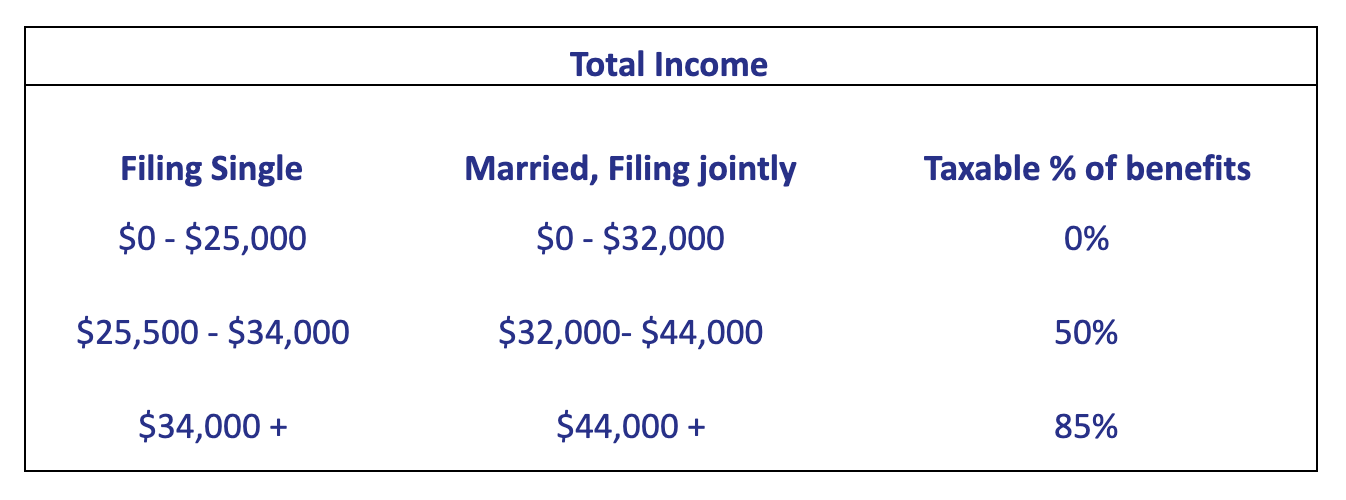

Before 1983, retirement benefits were tax-free, but over time, to keep future benefits going, Congress passed legislation to tax social security. The tax schedule for Social Security is much better than your regular income tax schedule. The tax on benefits is a progressive schedule that allows for a portion of your benefits to be still tax free, but when other income is earned in the same year, up to 85% of your social security benefits could be included as taxable income.

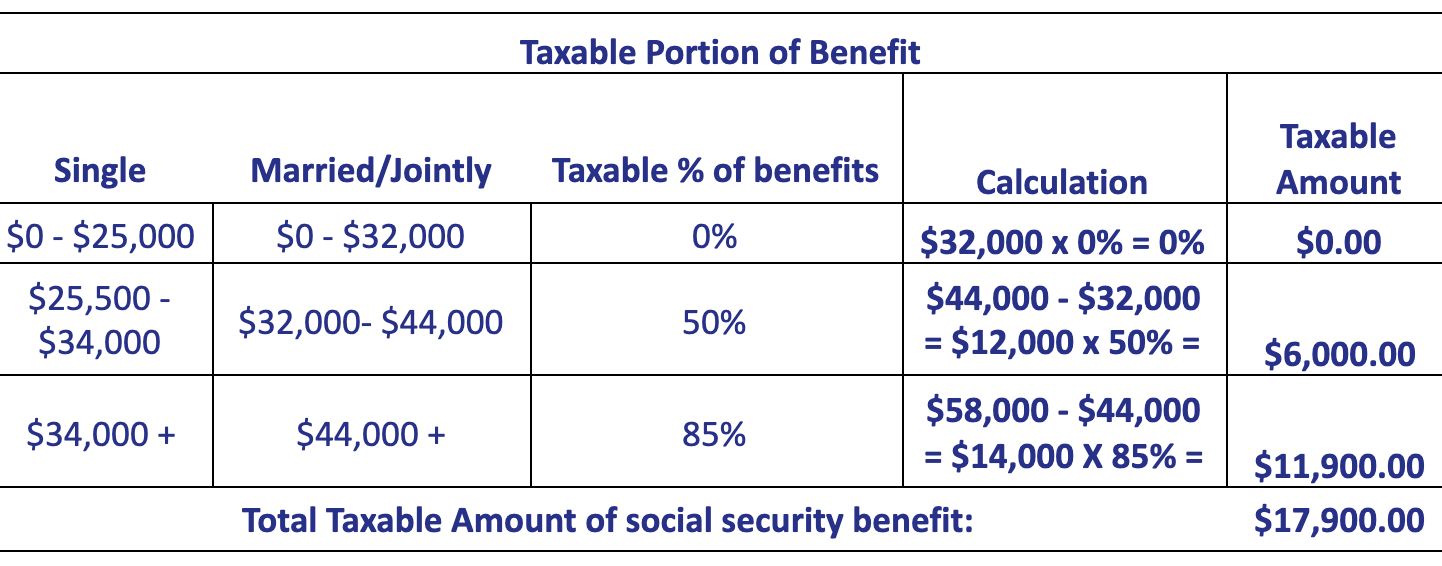

To determine the taxability of your benefits, you will need to determine your Total Income, which is a combination of adjusted gross income, tax-exempt income, IRA distributions, pensions, and ½ of your Social Security retirement benefit. The sum is put through the above tax schedule to calculate how much your Social Security benefit needs to be included in your taxable income.

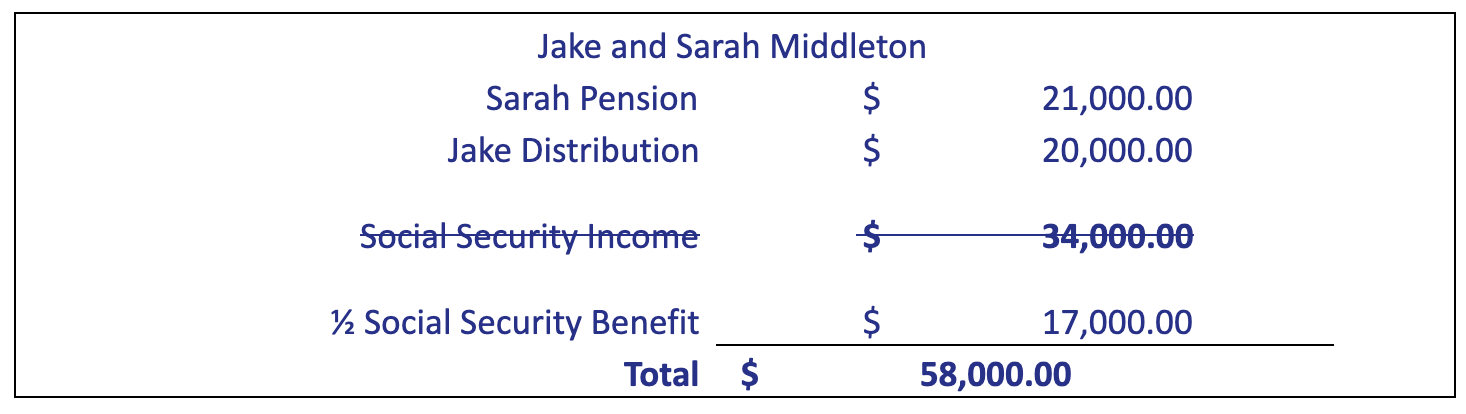

Let’s take a look at the following example of Jake and Sarah Middleton: They are both retired. Sarah collects a pension of $21,000 per year, Jake takes an annual distribution of $20,000 from his IRA and they receive a total Social Security benefit of $34,000.

Let’s take the total income of $58,000 and put it through the tax schedule from above.

$17,900 of the $34,000 is the total amount to be included as taxable income, which is 53% of their Social Security retirement income, which means they received 47% tax-free. The less income you have from other sources, the less your benefits are taxed, which benefits lower earners.

4. Can I work part-time and claim my retirement benefit at age 62?

Yes, but depending on how much you are earning for your part-time gig, you could be close to the Social Security income limits.

Let’s say your full retirement age is 67. Social Security will deduct $1 of every $2 you earn over $18,960 if you are under age 67. In the year in which you are turning 67, Social Security will reduce $1 for every $3 you earn over $50,520 up until your birthday month. Once you have reached the full retirement age, you will receive your full benefit.

Quick Note:- The withheld benefit is not lost money. Once you reach the full retirement amount, your benefit will be recalculated by Social Security and increased to account for the benefits previously withheld.

- Pensions and investment income is considered unearned income and therefore do not count against the Social Security income limit.

5. What is a spousal benefit?

After covering eligibility guidelines, benefit calculations, and taxation of benefits, it may be hard to think a currently non-working spouse is eligible for up to 50% of the working spouse’s FRA Social Security benefit, but it’s true!

Let’s take at Jake and Sarah Middleton from our earlier example: Sarah has been the primary source of income for the family for the last 40 years, while Jake worked a little initially but then became a stay-at-home parent and only working part-time after that. Sarah’s FRA Social Security benefit is $3,000/ month, and Jake’s is $900/ month.

Jake now has two scenarios:

- Jake claims his 'own' benefit at FRA: If Sarah claims her benefit at FRA (66) and Jake claims his own benefit at his FRA (66) then Jake would receive his $900/ month, plus a $600/ month spousal benefit so that his total benefit would be equal to ½ of Sarah's FRA benefit.

- Jake claims his own benefit at 62: Let's assume Jake is four years younger than Sarah. If Sarah claim's her benefit at FRA, but Jake claims his own benefit at 62, then Jake would receive a reduced benefit for himself (claiming early) and only 32.5% of Sarah's FRA benefit rather than 50%.

6. What happens to my benefits when I die?

Social Security does have a survivor benefit, but it does not allow the surviving spouse to continue to claim their own benefit plus the benefit of the deceased, but rather allows the survivor to receive a benefit equal to what the higher retirement benefit earner was receiving.

Going back to Jake and Sarah: Sarah's benefit is still $3,000/ month, and Jake's benefit ($900) plus the spousal benefit ($600) is $1,500/ month. Let's say Sarah passes away at age 80. Jake would drop the spousal benefit of $600/ month but would gain the survivor benefit of $2,100/ month so that he now receives Sarah's benefit of $3,000 per month.

7. When should I claim my retirement benefit?

'When should I claim my retirement benefit?' is the most asked question regarding Social Security and one reason why it’s a large part of our financial planning process. Even though your Social Security statements give you all the calculations and amounts for different times in which you could claim, the answer of WHEN, in most cases, is not simple and straightforward.

These are a list of questions to help give us insight into when you should claim:

- When do you want to retire?

- Do you want to work part-time?

- Does longevity run in your family?

- What type of assets do you own?

- Pre-taxed retirement accounts?

- All taxable accounts?

- Annuities?

- Do you have supplemental health care insurance?

- Do you want to leave a legacy to your family?

- Do you own a business?

- What is your risk tolerance?

When to claim Social Security is a piece of your financial planning puzzle and maybe one of the last pieces to be added to see the complete picture.

For instance, you may think that claiming at age 67 or age 70 is a no-brainer based on the dollar amounts when you glance at your Social Security statement. Still, depending on the type of assets you have or the number of assets you have, you may be pulling funds from your portfolio faster than they are growing while waiting to claim your benefit.

If you have questions regarding when you should claim your Social Security retirement benefit or are unsure what tax bracket you will be in during retirement, reach out to your advisor and set up a game plan.

The Burney Company is an SEC-registered investment adviser. Burney Wealth Management is a division of the Burney Company. Registration with the SEC or any state securities authority does not imply that Burney Company or any of its principals or employees possesses a particular level of skill or training in the investment advisory business or any other business. Burney Company does not provide legal, tax, or accounting advice, but offers it through third parties. Before making any financial decisions, clients should consult their legal and/or tax advisors.